Investing can be equated to reading tea leaves – It is hard to predict the future. This is especially true when trying to determine the macro direction of economies and in turn financial markets.

The easy path is to listen to all of the talking heads and “experts” and to the media spin. However, the media often overly reports on sensational news quotes to grab readers and viewers. This cycle tends to exacerbate the effect of the news as more and more people and outlets pick up the story. This has the effect of getting people whipped up either in extremes of fear or greed.

During my career I have had the pleasure of working with some of the best investors in the world. One who stands out for me is Kerr Neilson. Kerr founded Platinum Asset Management in Sydney, Australia with a $1 billion seed capital from George Soros.

The key investment tenets of Kerr’s is that humans tend to think mostly in the short-term and they tend to extrapolate recent information believing that recent trends will persist in the future.

These biases are good traits for certain aspects of our lives but are not generally desirable as investors. They cause the average investor to buy and sell at the wrong times and to vacillate between fear and greed. It is hard to go against the dominant, and often exaggerated, trends in financial markets and more generally in all aspects of life.

Today there are real concerns in many economies across the global financial markets. However, smart investors learn that economies and markets are two different things. Clearly they are coupled, but markets often disconnect from reality over shorter periods of time. They have tendencies to overshoot on the upsides and downsides.

Let’s unpack the major things happening in the world today and be thoughtful about how to factor them into how to invest now.

This research note covers:

- Inflation – Where are we now and how to profit from it

- The Fed’s Preferred Measure of Inflation and how this Affects our View

- A Deep Dive into how Inflation, Volatility and Sentiment are Affecting Markets

- Targeted Ways to Profit from Today’s Market Action

Inflation – Where are we now and how to profit from it?

The number one financial topic on most people’s minds now is inflation. We all feel it in our everyday lives as our money isn’t going as far as it once did. It is showing up in wages, gas, food, rents, autos, electricity, you name it. Pretty much everything we consume. This is making us nervous, especially for those at lower income levels as inflation acts as a tax by reducing purchasing power.

Inflation is not just an American phenomenon. In fact, it is currently higher in most of the rest of the world. Inflation is higher in other countries largely due to the strength of the dollar and regional energy shortages. The main transfer mechanism for this is via commodities as most major commodities are priced in US Dollars. As the US Dollar has risen, so have commodities in foreign currencies simply due to the strength of the Dollar. For example, the local cost of a gallon of gas in most of Europe is over $7 dollars (equivalent). The same holds for many other commodities.

Inflation is the Federal Reserve’s main enemy now for real and political reasons. Federal Reserve Chairman Jerome Powell for months insisted that inflation was transitory in spite of what Soaring Capital and many experts believed. (Please refer to our March 29th research note on “Profiting from Inflation, Volatility and Uncertainty“.)

Not only has inflation NOT been transitory, it has increased and broadened. The Fed has raised rates 75 basis points three times and has begun other quantitative tightening measures to try to get inflation under control. Yet inflation is still increasing as evidenced by recent economic data. This is not a surprise as monetary measures to control inflation work with a long lag time.

Inflation Persistence

If Chair Powell misread the persistence of inflation in 2021, do we think that he will correctly read it now and therefore take the correct actions?

Based on his public comments, he is determined to expunge the system of inflation and bring it back down to 2%. He has shown resolve in his comments and actions and appears not to worry about the economic consequences that might result from his actions to reduce inflation. If fact, he has publicly stated that he is willing to accept moderate increases in unemployment to quell inflation.

As a result of this information, we believe that there is a high probability of a policy error on behalf of the Fed. While we do strongly believe that the Fed needs to reduce liquidity, we believe that they should proceed at a slower pace.

If the Fed continues to tighten monetary policy rapidly, the question becomes how much will it damage the economy?

Managing monetary policy to engineer a specific economic outcome is much like steering a large ocean vessel. When you make a change of course, it can take a long time for that course change to become evident. It is difficult to navigate a straight course.

An Inflation Deeper Dive

The measures of inflation that the Fed is focusing on are generally driven by what happened in the past (lagging indicators). I am referring to measures of job openings, unemployment and wages. These indicators typically follow monetary actions with a lag of six months or more. Therefore, we are not likely to see the effect of the recent Federal Reserve tightening for many more months in the official measures of inflation.

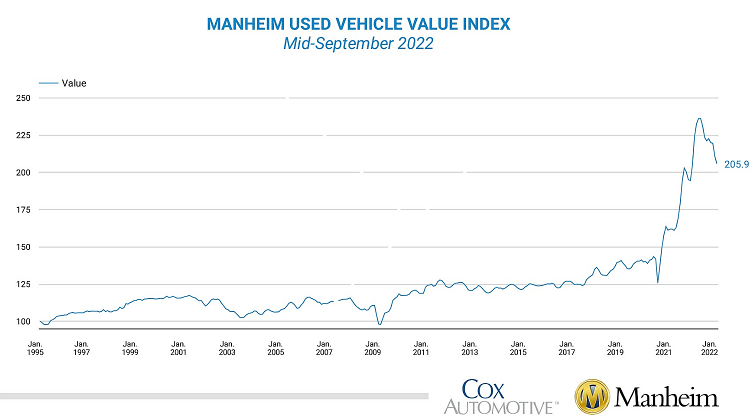

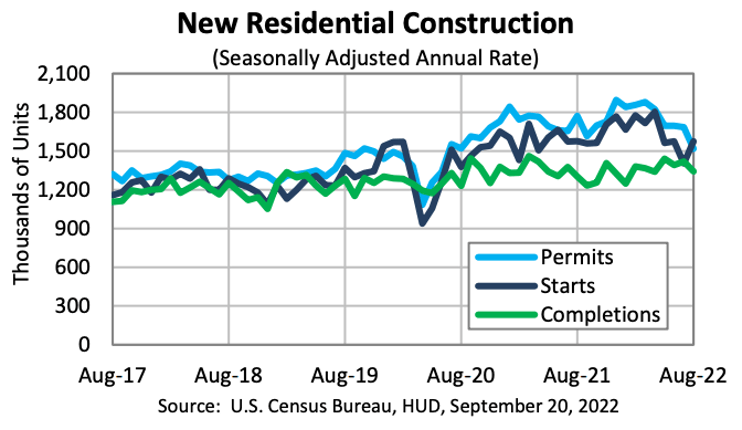

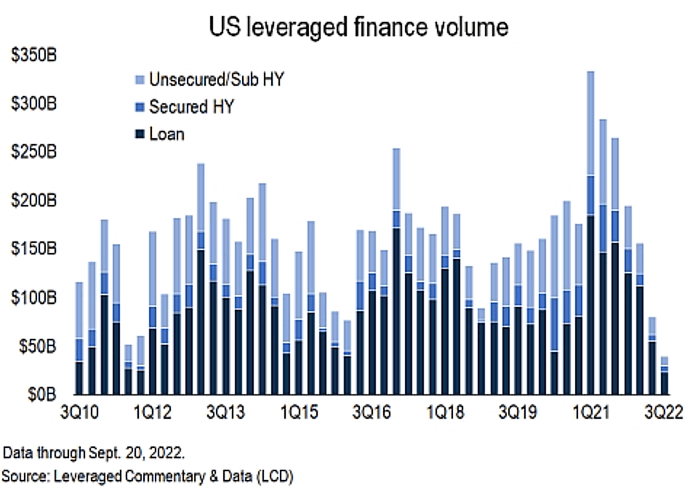

Other indicators, however, have reacted quickly and are indicating an economy that is softening. A few metrics that we look at are: housing, rents, new building permits, used car prices, commodity prices, interest rates, leverage loan underwriting volume, corporate and high yield bond risk premiums. All these indicate softness.

The Fed’s Preferred Measure of Inflation

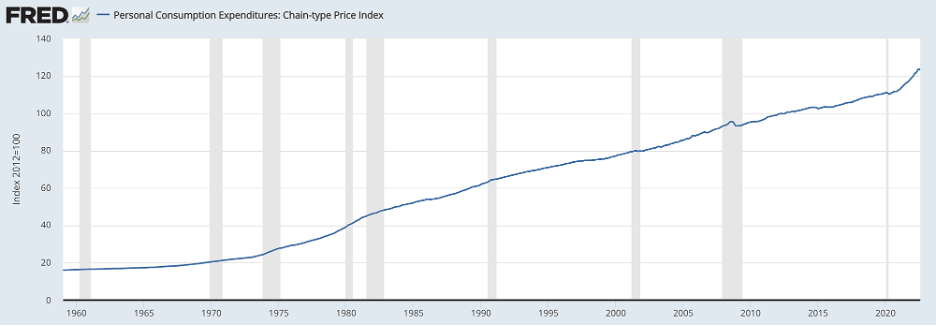

The Fed’s preferred measure of inflation is the Personal Consumption Expenditure Price Index Inflation, otherwise known as the PCE Deflator. This metric continues to show persistent and rising inflation.

One important metric not factored into the Fed calculus is sentiment. Besides the actual removal of liquidity from the monetary system, the actions of the Fed work through moral suasion. At the margin, the average individual, CEO, manager, or business owner will behave more cautiously as they fear we are heading into a recession. These small individual behaviors can lead to a large impact on overall economic activity.

Additionally, interest rates, as evidenced by Treasury bond yields, moved to much higher yields. Today short term Treasury bonds can be purchased at yields of 4% to 4.5%. These rates are much higher than the actual stated Federal Reserve Fed Funds target rate. Higher levels of interest rates affect all asset values. Higher rates lead to a contraction of growth.

The Initial Public Offering and Leverage Finance Markets

The IPO market has been all but dead with only 32 IPOs year-to-date. This represents a decline of 88%!

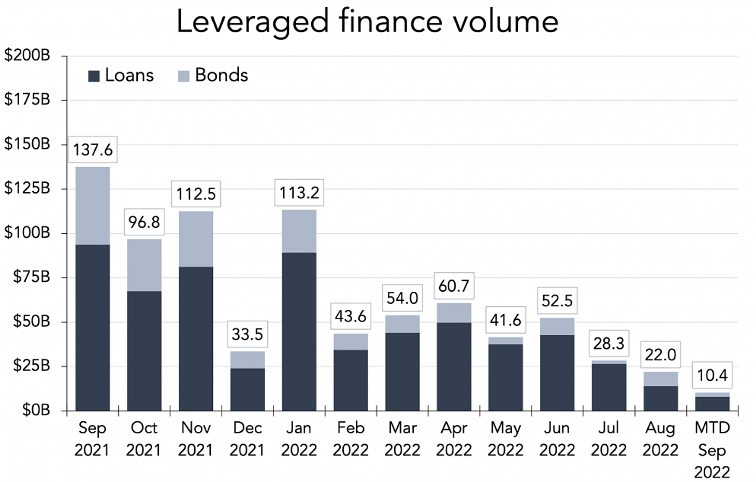

Likewise, leveraged loans and high yield issuance have essentially dried up with issuance down and yields up. This is causing leveraged companies to find it harder to refinance their debt and buyout firms are finding it hard to finance buyouts.

The investment banks that supported the April 2022, $15b leveraged buyout of Citrix Systems by Vista Equity Partners and Elliott Investment Management found it hard to find buyers for the Citrix loans. They were forced to take millions of dollars of losses on these loans to get them off their balance sheets.

Inflation and Corporate Earnings

Inflation not only impacts personal consumption, it affects corporate earnings. Companies are facing increased wage and input costs. Some companies can pass these increased costs along to their customers, others can’t and have to accept smaller profit margins.

Costco is a good example of this as they increased sales by 16% (10% excluding gasoline sales) but witnessed a 1% reduction in profit margin. They had to accept 8% input inflation during the third quarter. That said, Costco forecasts inflation reductions and higher profit margins going forward. They are seeing reductions in fuel, transportation, beef, cargo containers and others. How many other companies are in a similar situation?

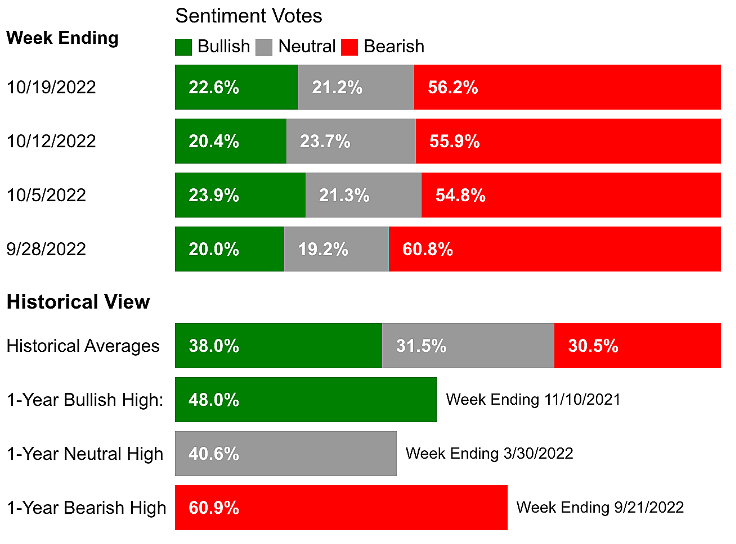

Investor Sentiment

Investor sentiment as measured by The American Association of Individual Investors (“AAII”) is currently measuring at one of the lowest levels in their 35 year survey history. Over 56% of investors are bearish as of October 19th. This represents a slight improvement from the middle of September when it hit 60%. The other time it reached a level lower than today was in March 2009. Levels of extreme negative sentiment are typically a good contra-indicator, meaning it is a good time to invest.

targeted WAYS TO PROFIT IN TODAY’S MARKET

High inflation, high commodity prices, bad investor sentiment – what does all of this mean for investors? Clearly this has been a bad environment to be a long-positioned investor. Not only have equities sold off, but bonds have declined in value by a similar amount as well. Additionally, this is not just a US phenomenon, as it has affected nearly every global equity and bond market.

Our view at Soaring Capital is that the Federal Reserve will back off from rapid interest rate increases once they see more signs of economic softness. We believe they will still increase rates, but will do so at a slower pace. We also believe that the Fed will be willing to accept higher inflation than the 2% that they have guided to.

As Paul Tudor Jones recently commented, “Inflation is a bit like toothpaste. Once you get it out, it’s hard to get it back in.” The theory being that some forms of inflation will prove to be very sticky and are unlikely to decline much in the absence of a deep recession. In particular, wage and owners-equivalent rent inflation are unlikely to move down in the near term.

Additionally, we don’t believe some components of inflation are being driven by monetary forces, and therefore they are unlikely to be reduced by monetary forces. I am referring to certain commodities like energy where there are structural issues with supply.

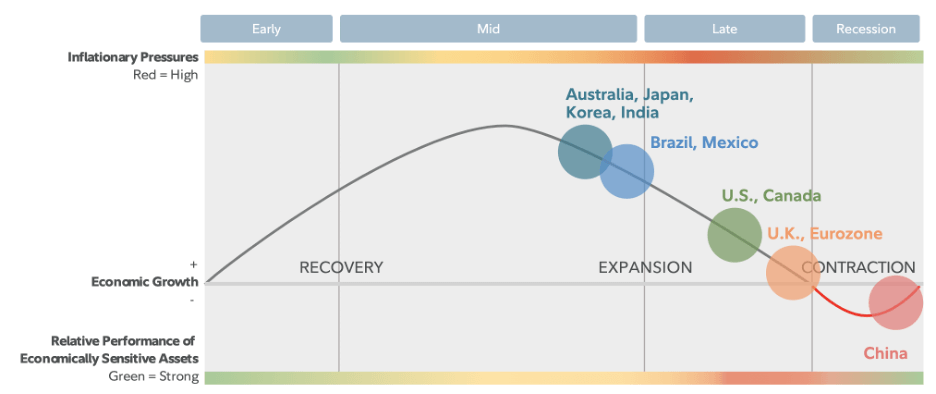

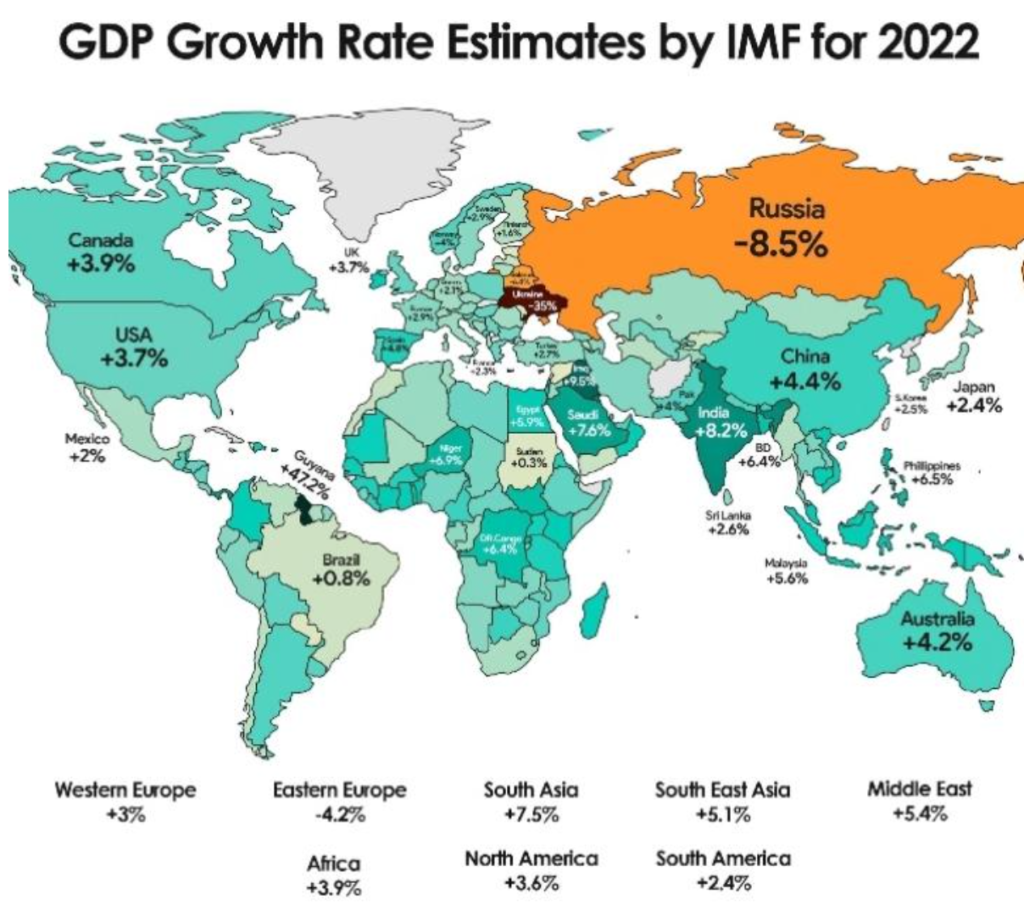

Looking around the globe at each geographic region, we see that there is coordinated economic slowing. While most of the world’s economies are slowing they are still showing expansion, albeit at a slower rate. Some countries like Australia, Japan, Korea, India, Brazil and Mexico are holding up much better than the UK/Eurozone and China.

Below is an excellent visualization of global growth rates for 2022 from the International Monetary Fund (IMF).

EQUITY SECTORS AND MARKET CYCLES

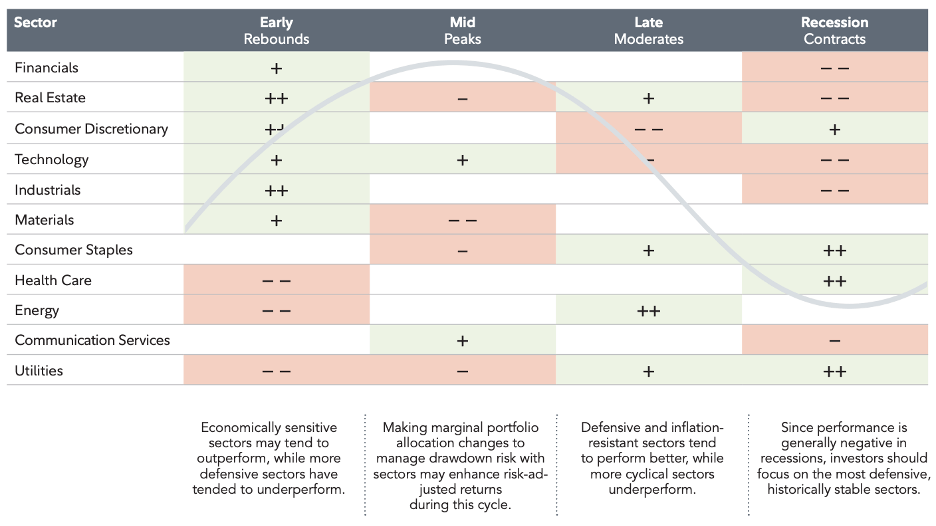

When looking at equity sector performance, the chart below provides a good guideline for the performance of each sector during various points in the economic cycle. This gives us some ideas as to where we should be allocating relative to where we believe we are in the economic cycle.

ENERGY

We have been fortunate to have allocated a meaningful amount of capital to the energy sector at the beginning of the year. The energy sector has been one of the few winners this year and it has accounted for our significant out-performance relative to the benchmark for our clients.

While this sector is not loved by ESG enthusiasts, we continue to believe energy is still a good place to allocate. In spite of everyone’s desire for clean energy (including our own), we will likely need fossil fuels for a long time still.

We have identified many outstanding energy related investments that we believe are reasonably valued and have years worth of growth ahead of them. These include exploration and production, oil service and pipeline companies.

One of these investments is producing 9% yield and trading at 7 times forward price to earnings. We are also invested in a pipeline fund. This fund is structured as a closed-end fund and is trading at a 13% discount to its asset value and providing investors with 8% yields.

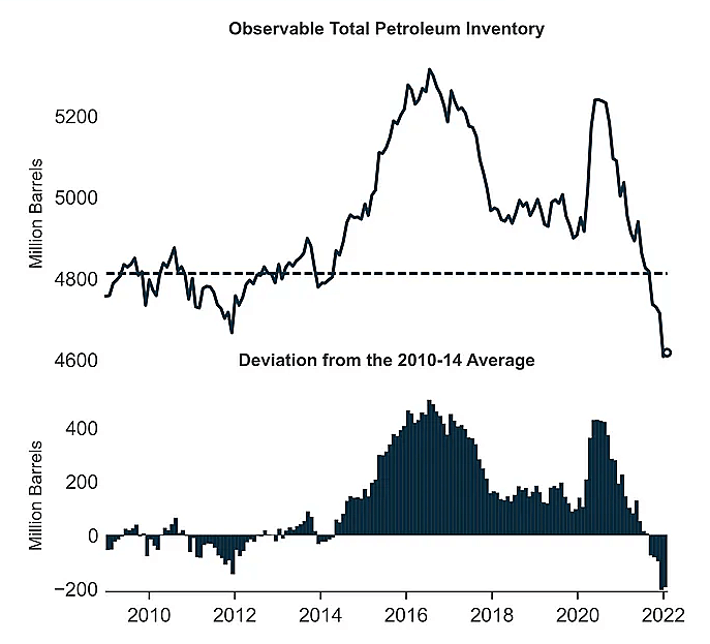

From a macro perspective, if we go into a deep recession, energy prices will likely trade down. However, the supply and demand balance will likely keep a high floor on price as the world does not have any meaningful excess supply. See chart below on current global oil inventories.

Volatility

In our March research note we discussed having an investment allocation that profits from volatility (so called “long vol”). We continue to believe that having this allocation makes sense now. The investment funds that we identified have profited from this market volatility and have produced between +25% and +35% net return year-to-date through September. Below are some other ideas that we implemented to capture return from elevated volatility.

1) Option Premium Capture:

When market volatility increases, option prices increase (all else being equal). This means that there are more opportunities to make money in the options markets. We have identified two investments that utilize this strategy. In this environment, these strategies are making outsized yield. One such fund is providing exposure to blue chip US equities while also providing clients with 11% annualized dividend distributions.

2) Structure Notes:

As volatility and interest rates increase, the pricing for structured notes also improves. Structured notes are contracts with banks or brokerage firms that provide a defined return or yield. Structured notes are a global, multi-trillion dollar assets under management business. Historically, they were only available to institutional investors.

Today, Soaring Capital has the capabilities to include structured notes in client portfolios and can structure them customized for each client.

There are two general types of notes: Income Notes and Growth Notes:

Income Note Example: Clients earn approximately 12% annualized yield on a 24 month note based on the S&P 500 index. The client will receive a 3% interest payment at the end of each quarter for which the S&P is not down by more than 30%. Additionally the client receives 100% of the investment principal back provided S&P does not decline more than 40% at maturity. Therefore at maturity, in 2 years, if the S&P is down 19% the investor receives 100% of investment back plus interest payments each quarter.

Growth Note Example: Clients earn 1.5 times the return of the lowest performer between the Dow Jones Industrial Index and the S&P 500 over a 24 month period. Additionally, the client receives 15% soft principal protection. If the S&P rises by 25% in two years, the note would provide a return of 37.5%.

Soaring Capital accesses these notes for clients on a zero commission basis, which increases the return relative to purchasing them via a broker or bank.

Short Duration Opportunities

As yields have increased, we now can earn much higher interest than in the recent past. For investors looking to deploy cash in a very conservative manner, we can build a portfolio that can yield 4 to 5% while maintaining a duration of around 2 years or less. Municipal bonds can now be purchased to earn approximately 6% taxable equivalent yield for 2 year bonds (for investors residing in high tax states).

Summary

Equity markets don’t always go up, and large moves to the downside do and can happen. In many ways, this market action represents a deflation of valuation excess as the majority of the market decline can be attributed to multiple compression and not earnings decline. Essentially, investors are choosing to pay less for assets. While we did see a slight decline in S&P 500 earnings growth, revenue growth has remained relatively strong and positive.

The actions by the Federal Reserve, the war in Ukraine and the lingering effects of COVID have conspired to make investors reassess their ways. This has created big losers and some winners. It has also provided great entry points for investors to buy quality companies at significant discounts.

The power of allocating when markets are on sale can be large and can compound for many years.

Examining some of my long term personal investments, simply from a yield perspective relative to purchase price, they have become massive compounders of wealth. One of these investments is now yielding over 60% per year based on my original cost basis!

This is possible for you as well if done correctly. The trick to investing is to properly read the tea leaves and not be shaken out as a weak hand. This is hard to do, but not impossible.

We look forward to connecting with you.

Best,

Brian

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control. Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in anyway. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

1 thought on “How To Read Today’s Economic Tea Leaves”

Good article.