Most people visit a doctor when they are sick. They don’t see a pharmaceutical sales person to discuss what medicines they are currently marketing. Frequently, however, this is what happens when individuals are looking for financial advice. Individuals are often persuaded to purchase a financial product that their broker is marketing without truly knowing if it is the best one to meet their needs.

Getting the right financial advice can significantly increase the odds of long-term financial success. Choosing the right advisor has the potential to result in over $1 million dollars in additional wealth. (see illustration in section 3 below)*

How does one increase the chances of getting the right financial advice?

There are a couple of key considerations that are important to understand about the world of financial services that will dramatically improve one’s odds of success. The five most important factors are:

- Understanding the difference between brokers and advisors.

- Being aware of conflicts of interest.

- Quantifying and monitoring investment costs.

- Understanding the different levels of asset protection.

- Understanding the range of investments and ideas different types of firms can offer.

1. Brokers are different from fiduciary registered investment advisors

One of the most important considerations when hiring a firm to manage your finances is to understand the differences between a broker and a fiduciary registered investment advisor (RIA).

Brokers are focused on sales of investment products versus longer term wealth accumulation and client wealth planning.

There are two main reasons why the distinction between broker and advisor is so important:

1. Alignment of Interests – Registered investment advisors’ interests are better aligned with their clients’ interests due to the compensation structure as well as legal obligations. Brokers/brokerage firms are sales oriented and earn commissions for selling investment products while registered investment advisors are focused on wealth accumulation and wealth planning and do not earn sales commissions. Fiduciary investment advisors are typically compensated under a flat fee arrangement and only earn more if the client earns more.

Brokers/brokerage firms are sales oriented and earn commissions for selling investment products while registered investment advisors are focused on wealth accumulation and wealth planning and do not earn sales commissions. Fiduciary investment advisors are typically compensated under a flat fee arrangement and only earn more if the client earns more.

A broker/brokerage firms’ interest might not be completely aligned with consumers as the investment products that are often sold to the client are the products that produce the highest level of commission for the broker. Consumers who work with registered investment advisors will by law receive a solution that is in the clients best interest.

2. Fiduciary Standards – There are material differences between the standards of care that a broker must adhere to versus that of a registered investment advisor. While the fiduciary requirements for brokers have been strengthened in recent years, they are far behind those of a registered investment advisor. The fiduciary requirements for Advisors are laid out by the SEC and can be found here.

In summary, registered investment advisors must:

- Operate at the highest level of fiduciary care and are legally bound to always put the interest of the client ahead of their own;

- Invest client’s assets in an optimal manner relative to their goals, objectives and risk tolerance and always do what is in the client’s best interest;

- Not charge commissions; and

- Avoid all conflicts of interest.

In the United States, there are over 600,000 wire-house brokers but only 13,000 who are qualified as registered investment advisors.*

It is worth noting that many investment firms are dually licensed as both brokers as well as registered investment advisors. This means that these firms can charge commissions when it is in their best interest to do so and then act as an advisor during other times. Under this “hat switching” arrangement, the client may not know when they are being treated as a brokerage client versus an advisory client.

One can use the SEC website at https://adviserinfo.sec.gov/ to search for firms and advisors to determine if they are a broker, advisor or dually registered.

2. Conflicts of INVESTMENT

Unless someone has worked in the finance industry, they may not be aware of the wide variety of potential conflicts of interest and how they might affect an investor.

Often, investment/brokerage firms have many divisions, each serving different constituents. Firms like Goldman Sachs, Morgan Stanley, JP Morgan, UBS, Bank of America Merrill Lynch, Raymond James and others have at least three legally distinct and different divisions within the company: 1) broker-dealer/brokerage; 2) asset management; and 3) wealth management. Each of these divisions are in inherent conflict with each other.

So where does the conflict of interest come into play?

A common example of a conflict of interest with these types of firms is when the broker invests client assets into an investment product that was created and managed by the asset management division of the same firm. Often, the broker will receive extra compensation or incentives if they invest their client’s assets into the firm’s own investment products.

What is wrong with this one might ask? For one the investment might not be the most suitable/appropriate investment for the client and second, it might be more expensive than other options available. When working with a registered investment advisor such as Soaring Capital, such a transaction would be unethical and in fact illegal.

Clients are typically unaware that they are paying extra and that there are cheaper, and just as effective and suitable, products available. Extra costs and high investment expenses can have long-term negative effect on the client’s investment performance and may jeopardize the financial well-being of the client. We’ll explore this topic in more detail below.

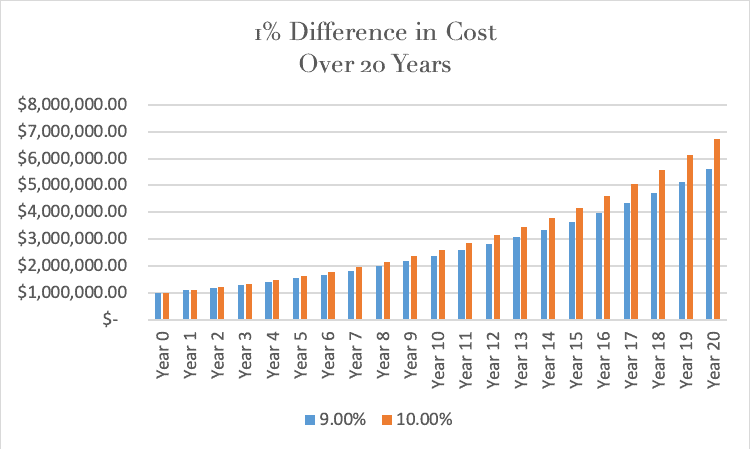

Investment expenses matter and can have a significant effect on investment performance over the long-term. A one percent lower cost investment portfolio, could result in a $1 million gain or more for the client over a 20-year period!

3. INVESTMENT EXPENSES

Investment expenses matter and can have a significant effect on investment performance over the long-term. A one percent lower cost investment portfolio, could result in a $1 million gain or more for the client over a 20-year period!

Clearly cost and expenses are important factors of investment success. An investment portfolio that is saddled with overly expensive investments can have a deleterious long-term effect on the overall return that the client realizes. As with most aspects of investing, there are subtle but important considerations to be aware of. There are two main cost components to be mindful of:

- Expense Ratio – the cost of the investment products that are used in a portfolio

- Advisory/broker Fees – the cost of advisory/broker services.

Comparing the cost that a registered investment advisor charges for advice and ongoing management is easy to understand and transparent. This fee is clearly disclosed in the investment advisory agreement. However, the ongoing costs (expense ratio) and upfront fees for the investments in the client portfolio are much harder for the average investor to understand and compare.

The expense ratio information is often not disclosed or discussed with clients. Sometimes added costs can be layered into a portfolio by a broker recommending an in-house investment product or using a higher cost mutual fund when a lower cost and more tax efficient ETF would be preferred.The difference between a mutual fund with a sales charge (SEC 12b-1 fee) and an ETF could be a difference of 5%. This 5% directly impacts the amount of money that the client ultimately retains

The lower fee portfolio returned $1,100,000 more over a 20-year horizon!

As a simple illustration we compare the performance results for a client who invests $1,000,000 over a 20-year period. We assume that the only difference between the portfolios is the expense ratio. One portfolio has a cost/expense structure that is higher by 1%. The added expenses cause the portfolio to earn 9% annually vs. 10% annually for the lower expense structured portfolio. Each portfolio starts with a $1 investment. After 20-years, the lower expense portfolio ends with $1,100,000 HIGHER balance. ($5.6 million vs $6.7 million)!

Soaring Capital recently started working with a new client. After analyzing the clients’ existing portfolio, we were able to reduce the number of investments, upgrade the quality of the investments, reduce the portfolio level risk and reduce the expense ratio by over 60%!

4. Protection of Assets

Often there is confusion regarding the different levels of protection investors have at different types of financial institutions and what the protection covers

When an investor has their money in a savings or checking account at a bank or credit union (or the banking division of an investment firm) the assets are protected by FDIC (Federal Deposit Insurance Company) up to $250,000 per account. However, the client loses these investor protections the moment the assets move to an investment account that is under the umbrella of a bank or credit union. [Same institution, different division.]

The perception of safety investing with a bank is false.

When working with a registered investment advisor, the assets are always held at a qualified SEC registered custodian in the name of the client. The client’s investment securities are covered by SIPC (Securities Investor Protection Corporation) up to $500,000 and cash held in the account is protected up to $250,000 per account.

It should be noted that registered investment advisors cannot withdrawal or transfer funds from the custodian (other than for payment of fees).

5. Access to research, resources and INVESTMENTs

One of the key benefits of working with an independent registered investment advisor is the open architecture nature of the platform. What this means is that we have access to virtually any:

- Investment product

- Investment research (including from Goldman Sachs, Morgan Stanley, , Blackrock, JP Morgan and others)

- Analytical tool

- Freedom of thought

Brokers or advisors at large firms are often limited to using only the firms’ approved and limited list of investment offerings, analytical tools and must invest client assets according to the view or asset assumptions that are set by the firm’s chief investment officer.

Independent registered investment advisors are open architecture, which means they have access to virtually any investment product that best suits the client’s need.

conclusion

In conclusion, when in need of financial advice, there are important things to keep in mind that will greatly improve your chances of success:

Broker vs Registered Investment Advisor – To receive unbiased advice, it is recommended that you hire a true fiduciary registered investment advisor and not a broker or hybrid, dually registered broker/advisor. Fiduciary registered investment advisors have a better alignment of interest with the client. Brokers operate under a sales commission model versus an advice, fee only model.

Fiduciary Standards Matter – Only registered investment advisors operate at the highest fiduciary standard which puts the clients’ interests ahead of the firm; avoids conflicts of interest; and does not charge sales commissions.

Conflicts of Interest – Wall Street is a multifaceted industry that frequently has conflicting divisions within the same firm. Knowing which division is servicing you will help you to understand the angle and perspective and potential conflicts of interest.

Investment Costs – It is imperative to keep investment expenses and fees low as high costs will have a material, negative impact on performance.

Protection of Assets – Banks/credit unions don’t provide additional asset protections versus registered investment advisors.

Access to Investments and Ideas – Registered investment advisors have access to virtually any investment offering and have freedom of thought whereas brokerage or large investment firms may limit the products available and make their brokers conform to the firm’s market outlook.

If you are interested in exploring what a fiduciary registered investment advisor can do for you please contact us using the button below.

Disclosures*

*Data sourced via FINRA at https://www.finra.org/media-center/statistics and FA Magazine https://www.fa-mag.com/news/ria-firms-top-record–110t-aum–60-million-clients–iaa-reports-62858.html

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control. Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in any way. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.