Article by Brian F. Moss CFA, CEO of Soaring Capital and Brian Shapiro, CEO of ALTSMARK

The following article was originally published in WealthManagement.com and was co-authored by Brian Moss, CEO of Soaring Capital and Brian Shapiro, CEO of ALTSMARK. ALTSMARK’s systems provide firms like Soaring Capital with detailed alternative investment reporting solutions. They are a 2021 Wealthmanagement.com Industry Award Finalist demonstrating outstanding achievement.

High vol, low vol, no vol, inflation? Maybe it’s transitory, but maybe it’s not. Overcrowded trades. GameStop, Game over? Not by a long short as uncertain markets bring certain opportunities for the advisor willing to look for them.

We see alternative investments, once the exclusive purview of ultra-high-net-worth and institutional investors, as the new opportunity of choice and alpha for smart advisors and their clients. In the the current investment environment, the classic 60/40 (60% weighting to stocks and 40% weighting to bonds) allocation will soon be relegated to the history of finance textbooks.

The great migration to alternative investments has already begun and will only accelerate in 2022, with 40% of wealth advisors reporting that they already accessing the private markets, excluding liquid (publicly traded) alternatives. Most investment wirehouses (57%), 43% of hybrid RIAs and 64% of retail bank broker/dealers are currently accessing alternatives for their clients.

While there has been an explosion in the number of publicly available investment products, many market opportunities are still not readily accessible via traditional exchange-listed investment vehicles. Some of the best alpha/return is generated by private investment allocations. Examining endowment returns for 2020-2021 reveals that a significant amount of the extraordinary 30% to 50% gain was generated by private allocations. Endowments have historically relied on a heavy weighting to private capital including hedge funds, venture capital, private equity and direct deals. There is no reason not to allocate a portion of private client capital similarly.

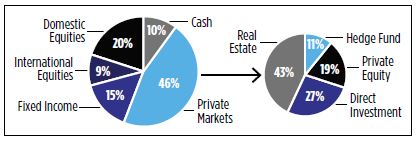

The following asset allocation demonstrates how alternative investments could be added to a portfolio. Use of alternative investments as part of an integrated portfolio allocation often produces a more efficient investment outcome with a higher return at a lower level of risk or Sharpe Ratio. Given the decline in the number of publicly listed companies, achieving true diversification without an allocation to private markets has become more difficult.

Among Ultra High Net Worth, Endowments & Foundations, Private Capital Dominates:

The performance numbers speak for themselves, 10.1% annualized over ten years and 13.5% over the past five years based on published reports.

Building portfolios of alternative investments takes time and the willingness to educate clients. Most of us like things that we can easily understand, and the 60/40 model is simple to explain and understand. It’s harder to explain convertible arbitrage or private equity, but with right kinds of risk and reporting technology, an advisor can show rather than tell their clients and a picture is with 10,000 basis points!

Over the next five years, we see alternative investments growing by 8% annually to $24 trillion by 2024. We also see individual investors embarking on an allocation shift akin to the one institutional investors have made over the last decade. But for that to happen, investors and advisors need to overcome a key impediment – their awareness of and comfort with alternative investments.

The reality is that alternative investments are not a single asset class. Alternatives include an array of assets, strategies and structures and should not be construed as some monolithic investment or a single slice in the allocation pie. It’s these varying strategies and their unique characteristics that make them the perfect complement to traditional public market strategies.

There is no simple approach to building a comprehensive, diversified allocation to alternative investments – one that considers investors’ distinct liquidity, return goals and varied time horizons. However, by allocating across the major alternative asset categories in both liquid and less liquid vehicles, advisors and investors may establish and maintain a comprehensive and strategic exposure to alternatives to complement their traditional allocation.

Brian F. Moss, CFA is the Founder and CEO of Soaring Capital Management, LLC.

Brian Shapiro is the Founder and CEO of ALTSMARK. Learn more about ALTSMARK

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client Investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control. Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in any way. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.