“Remain calm. All is well”

Kevin Bacon as Chip in Animal House

Some of you might remember a scene in the movie Animal House where actor Kevin Bacon is trying to calm a raucous crowd with the words “Remain calm. All is well.” This didn’t go as planned for him as he was soon flattened by the stampeding crowd.

The situation that is unfolding in the U.S. regional (now global) banking system is scary and unsettling for sure.

It is my view that this crisis will likely be contained and that the majority of banks will NOT be flattened like Kevin Bacon. However, the range of potential outcomes is wide and made wider by a number of factors that I explore in this email.

As investors and stewards of capital, it is critically important to explore and understand this situation at a deep level. Every time there is an event like this, I find it instructive as to what can be gleaned about markets, including the positioning of participants, stress sectors, and areas where we can profit and areas to fade and avoid. These events are like canaries in coal mines that can provide useful signals.

As to the current financial/banking stress, we need to know:

- Are assets safe in banks and brokerage firms?

- How did the banking system get into this situation and how can we avoid it in the future?

- What are the likely paths forward from here?

- How do we protect our portfolios?

- How do we profit from it?

It is best to start with some history on Silicon Valley Bank (SVB) and what is unique about this bank.

Silicon Valley Bank History

How could the 16th largest bank in the U.S. suddenly default? SVB’s default was the largest bank failure since 2008 when Washington Mutual defaulted. SVB equity was trading at $717 per share on October 1, 2021, implying a $42 billion dollar market value and now it is worth ZERO!

Most people went to bed on Thursday night (March 9th) and didn’t question the stability and access to their bank deposits. Today many question that.

How did SVB and some other banks get in this position?

The world is still being impacted by the long-tailed economic effects from the pandemic. These forces directly impacted SVB, Signature and Silvergate banks and potentially other banks.

Venture capital and public equity market sectors such as biotech, software, clean-tech and ecommerce raised billions of dollars during this time. In 2021 alone, there were 613 special purpose acquisition blank check company (SPAC) initial public offerings that raised over $160 billion dollars. There was an equal amount of private capital raised from venture capital limited partners.

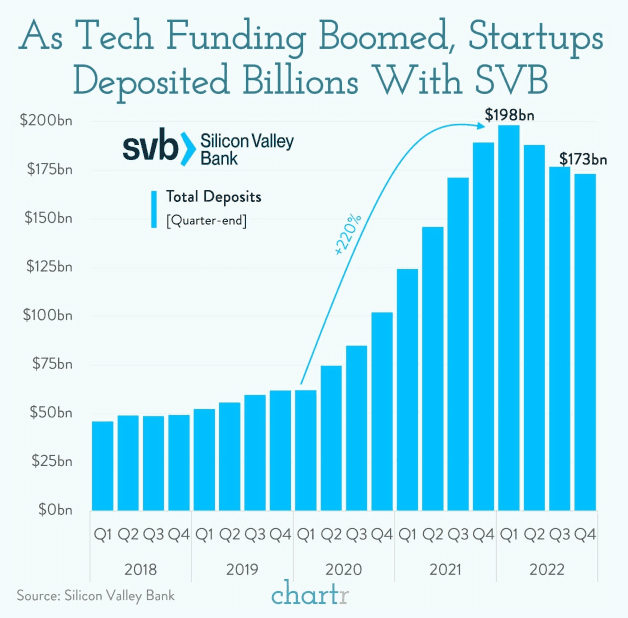

The majority of this capital flowed to SVB. See the charts below.

During the pandemic, governments pumped liquidity into the economy at an unprecedented rate. This acted like fire stimulant to certain sectors of the economy and markets. Much of this extra liquidity showed up in the stock market, housing market and some of the most speculative sectors of the start-up/venture economy.

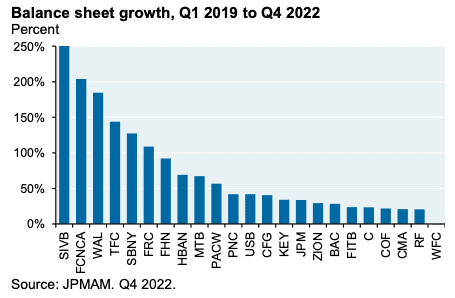

The chart below shows the balance sheet growth of banks from 2019 to the end of 2022.

This capital flow became a liability on the balance sheet of the bank as they needed to earn a return on these deposits.

When SVB received these deposits the yield on “safe” Treasury bonds and government backed MBS (mortgage backed securities) was historically very low. The yield on the 10-year treasury ranged from 0.8 to 1.5% at that time.

This yield was kept artificially low by the actions of the Federal Reserve (Fed) and many of the world’s central banks. The Fed believed that inflation was transitory, which allowed them to continue to pump liquidity into the system by buying Treasuries and mortgage backed securities. These actions kept interest rates and yields low.

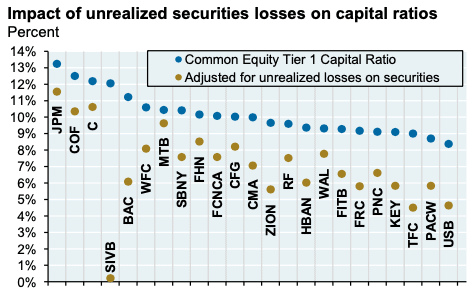

The net interest margin that SVB was earning was very good at that time. [Net interest margin is the spread that a bank earns from their deposits.] However, as interest rates rose, this margin collapsed. At the same time, they experienced paper losses on their holdings of Treasury and agency mortgage backed securities when rates rose. This left SVB in a precarious position as their adjusted Tier 1 capital ratio did not leave them with any cushion. When the bank realized that it needed to raise capital, it was too late, as no one in their right mind would own their equity at that point. At this point SVB sold their investment holdings at a discount to Goldman Sachs to try to provide liquidity. They realized a $1.8 billion dollar loss on this sale.

The irony is that the deluge of capital that flowed into SVB from venture capital and private equity at a time of historically low rates was more of a curse than a blessing.

One can see graphically in the chart below from JP Morgan how little adjust Tier 1 capital SVB has at the end of the 4th quarter 2022. No other bank is even close to their level of adjusted capital.

Another complicating factor for SVB was the fact that their main clients (start-ups) stopped adding to their deposits. Previously, these start-ups were able to issue equity as a source of funding. However, as investors reduced their appetite for start-up/venture investing, these companies were unable to raise more capital so they withdrew their cash held at SVB to fund their operations.

Compounding matters was a tweet that Peter Thiel sent to his venture investment companies advising them to pull their money from the bank. This caused a modern day bank run, with much greater digital speed.

Implications

There are a number of interesting aspects to what happened with SVB that are worth exploring.

What does this impute about the overall economy, the banking and finance sectors, banking regulation, inflation, the path of interest rates and future actions by the Federal Reserve? How does social media affect a bank’s stability? How will the response by the government and individuals change behavior? Will banks going forward tighten their lending and investing standards?

There are some of the many questions worth probing.

It is my belief that in general our assets are safe in banks and brokerage firms. The U.S. Government and most other governments are prepared to step in to rescue depositors from losses if held at a failing bank. Even if these deposits at the bank exceed the insured threshold. The FDIC insurance program was established to rescue depositors.

Brokerage firms versus Banks

It is also worth noting that brokerage firms are very different from banks. Brokerage firms such as Charles Schwab, hold custody of over $7 trillion dollars of securities for clients. These securities are held in each client’s name and are segregated from the bank that Charles Schwab manages. Charles Schwab does manage a bank and it has $550 billion in deposits. The bank is managed very conservatively and has a very diverse client base. The Charles Schwab bank is very different from SVB.

The Schwab bank deposits are comprised of the cash sweep assets that are held in Schwab brokerage accounts. Most of Soaring Capital’s client cash balances are not held in a Schwab sweep account at Schwab but are instead held in a money market account which is not related to the Charles Schwab bank. We are able to earn much higher yields on these balances and take very little risk in doing so.

Rapid Rise in Interest Rates

One factor effecting banks is the increase in interest rates and the way that rates have increased. As short term rates have risen, investors have begun to move money out of banks. This acted to destabilize their deposit base.

This money flowed out of cash deposits held at banks and into money market funds and short term Treasury securities. The incentive to do this was to earn much higher returns. For example, one is able to invest in a money market fund and receive 4.5% to 5% interest versus 0.01% on a bank deposit! Which would you prefer?

Social Media and the Impact on Banks

What does social media have to do with banking? Banks are ultimately reliant on depositors’ faith in the bank to operate smoothly. Customer deposits are used to extend long duration loans to businesses or to individuals. The bank only keeps a small portion of the deposits in readily available cash. The amount that they keep is normally adequate under most scenarios. However, the moment depositors en-mass start to lose confidence they demand their money back, which can cause the bank to collapse. This is the cause of many bank failures.

What has changed is the interrelatedness and speed of all of the digital world. Most of us are a tweet, social post or email from news that might scare us causing us to act in a certain way out of fear or greed. I am not implying that the tweet from Peter Thiel caused SVB to collapse but it certainly precipitated it. This is a societal change that needs to be watched.

Start-up Economy

What does the collapse of SVB imply about the health of start-up and venture capital backed companies?

It is my belief that the start-up/venture capital ecosystem is in worse shape than most investors recognize and that it will likely be harder for them in the short to medium term. The main reason for this has to do with the ability of these companies to continue to fund unprofitable businesses. Lenders and investors will exhibit increased caution when purchasing private shares and/or lending to these businesses; this will in turn strain and/or cause some to go out of business.

Banking Sector Broadly

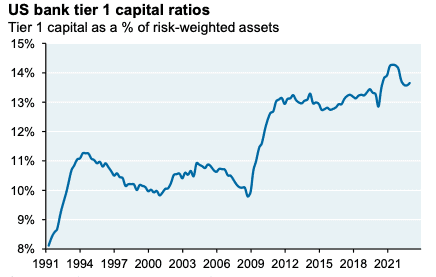

Are all banks in bad shape and nearing a default? I don’t believe that is the case. While the range of outcomes certainly has increased, I don’t believe that we will see a complete collapse of the banking system. If you look at the U.S. Banking System Tier 1 capital ratios, you see a healthy cushion of capital across the system. See the graph below from the FDIC

Impact on the Economy

Anytime fear and uncertainty is injected into an economy it hurts confidence and sentiment and will likely cause a mild contraction in spending over the short to medium term. In spite of the government backstop of all deposits, people are still nervous.

Financial Market Impact

If you look at the market action in the U.S. Treasury and gold markets – these moves imply a lot of fear. The moves in these markets are dramatic. You have to look back to 1987 to find moves as violent as these. Volatility across all risk assets has spiked on concerns that we will enter a recession. Crude oil is down significantly and equities sold off.

Course of Monetary Policy

Does the default of SVB effect the course of monetary policy by the Federal Reserve? Will they ease back on the tightening of monetary policy? The banks that defaulted were the consequence of the maneuvers of the Fed. Is this the first of many cracks that will show up as the result of Fed policy actions?

I believe the Fed is determined to squelch inflation in spite of these economic cracks and therefore the likely path of Fed policy is tighter, but perhaps at a slightly slower pace. I think there will be more cracks. While the recent events are de-inflationary, the inflation and employment numbers are still much stronger than the Fed would prefer. Therefore, I am forecasting that they will continue to hike rates.

Regulatory Failure

Was there a regulatory failure around SVB? How will regulation change as a result? Will capital requirements for banks be increased? I believe that there were likely some regulatory/supervisory problems that failed to catch the problems at SVB. Ultimately the government will tighten regulation and undo the Dodd-Frank 2018 lessening of regulation on mid-sized regional banks.

Lessons

There are a number of key investment lessons we can learn (or relearn) as we live through this and other crises. Many of the lessons go back to fundamentals such as diversification, asset liability matching and risk management.

SVB failed to manage a diversified business in both their client base as well as with their investments. Additionally, they allowed for a large mismatch in the duration of their deposits and the duration of their assets. Finally, they failed to risk manage their portfolio properly. Perhaps they lost sight of the fact that there was significant price risk associated with owning government securities.

As someone who worked as the co-head of fixed income strategy at UBS and as a risk manager, I have a keen appreciation for these risk factors. Risk management is key to long term investing success. Investing success is often best accomplished by limiting downside and hitting lots of singles and doubles.

Opportunities and Positioning

I don’t believe that the recent events will be a catalyst to put the economy into a deep recession. However, I do believe that the risks have increased.

Each recent bank that failed did so due to an exaggeration or concentration of risks. While these same risks exist in the banking system at large, they are less impactful for the majority of banks and therefore are likely to be contained. There are banks that have similar aspects as that of SVB. These banks will struggle and could default.

As a result of these forces there will be a continued flight to quality across banks and markets in general.

It is at moments like this when fear grips the market, when lots of money can be made. One has to separate the good from the bad and invest appropriately. I do believe that there are great opportunities in some companies in the banking and brokerage sector. There are companies in the financial services sector that have little to nothing to do with the banking crisis. These companies represent great buying opportunities that we are taking advantage of.

In general, the bank sector is not one that we are particularly bullish on as net interest margin is likely to be slim to negative for some time.

I have generally had a cautious stance on equity and bond exposure and have favored value/discounted sectors. For bond allocations, we have be able to take advantage of market volatility and use tools like structured notes to capture stable, protected income.

We recently invested, for example, in an income note across client portfolios that provides 10.5% annualized interest with 40% downside protection for the coupon and principal. We have also relied on “bond like” assets that give us yield and non-correlation and have employed options strategies that capture income from the market volatility versus being just long equities.

There is plenty to do in the markets today to help us all grow and protect our wealth.

Thank you for the lesson Mr. Kevin Bacon!

I look forward to connecting with you.

Best,

Brian

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control.

Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in anyway. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.