Capture 150% upside and only 90% of the downside.

Earn positive returns when the market declines.

These are two examples of how structured notes can help you grow and protect your wealth.

At Soaring Capital Management, we understand that the investment landscape is constantly evolving, and investors like you are looking for opportunities that combine the potential for higher returns with the security of capital preservation. Our mission is to provide you with the knowledge and tools to navigate this dynamic landscape effectively. With structured notes, we can provide defined return outcomes that offer more certainty around returns.

Structured notes, with their unique blend of fixed income components and derivatives, offer a pathway to financial growth while mitigating risks. As we explore various types of structured notes, from income-focused options to growth-enhancing choices, you’ll gain a clear understanding of how these instruments can fit into your investment portfolio.

As you delve into the world of structured notes in this guide, you’ll discover the benefits, risks, and return potential associated with these instruments. Our aim is to empower you with the knowledge to make informed investment decisions and to offer you opportunities that can help your wealth soar to new heights.

Whether you’re a seasoned investor looking to diversify your portfolio or a newcomer seeking financial guidance, Soaring Capital Management is here to assist you on your wealth-building journey.

What are structured Notes?

Structured notes are hybrid securities whose outcomes are tied to the performance of an underlying asset or set of assets including equities, indices, currencies and/or commodities.

For decades, structured notes were only available to institutional and ultra-high-worth investors with minimums of $1 to $10 million per note. Today they are available to all investors with much smaller investment minimums through qualified registered investment advisory firms such as Soaring Capital Management.

Soaring Capital sources commission free notes from a variety of the best, most well capitalized, global issuers such as JP Morgan, Citibank, Bank of America, Goldman Sachs and others. As a fully independent registered advisory company we are not beholden to any one firm’s note offerings. We are free to choose the best note option based on risk, return, pricing and terms and conditions that are best for each client.

In this guide, we define the most common types of structured investments and discuss the benefits and risks of each type.

the structured Note market

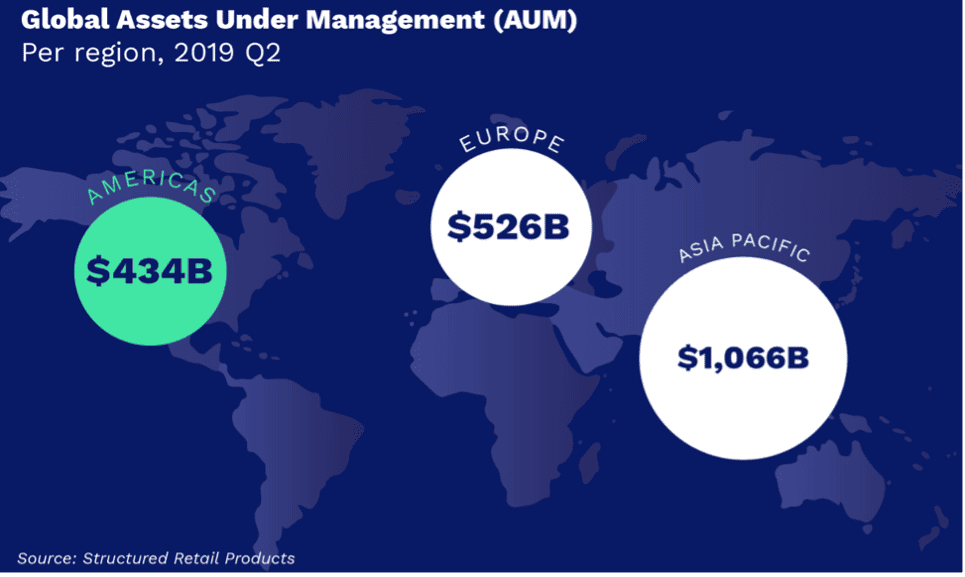

The structured note market is a very large and global market both in terms of the number of notes issued and the dollar amount. There are approximately $2 trillion of notional value of notes outstanding globally and growing. The amount of new issuance in the US alone in 2021 was estimated at over $100 billion. As you can see from the graphic below, much of the issuance has been outside of the US, however the growth of the market in the US is rising at a fast pace.

What are structured Notes?

Structured notes are hybrid securities that are issued by major banks. Underlying the notes are a bond component and a derivative component. The derivative component is a financial security with a value that is derived from an underlying asset such as a stock or an index.

The notes provide a defined outcome that is structured in a way that is optimal for each investor.

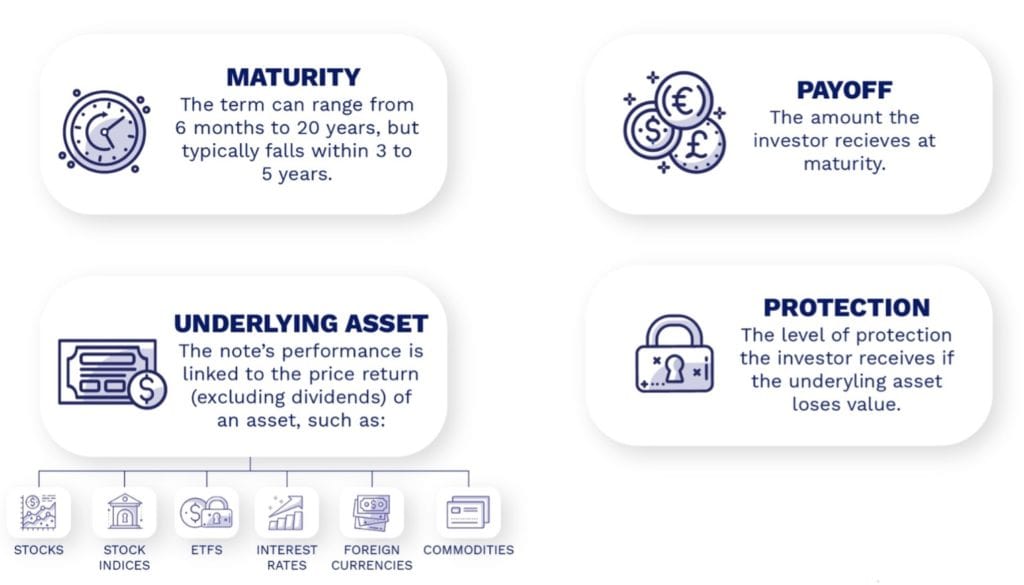

All Structured Notes Have Four Simple Parameters:

As long as the underlying asset(s) is not down by more than the protection level at maturity, the investor will receive their initial investment back in full plus the income and multiple on the underlying asset(s). Subject to the credit risk of the issuer.

TYPES OF STRUCTURED NOTES

While there are many of types of structured notes, the two main types of notes are:

- INCOME NOTES

- GROWTH NOTES

There is a sub-category of notes that are FDIC Insured and can offer much higher yields vs. traditional Certificate of Deposits (CDs).

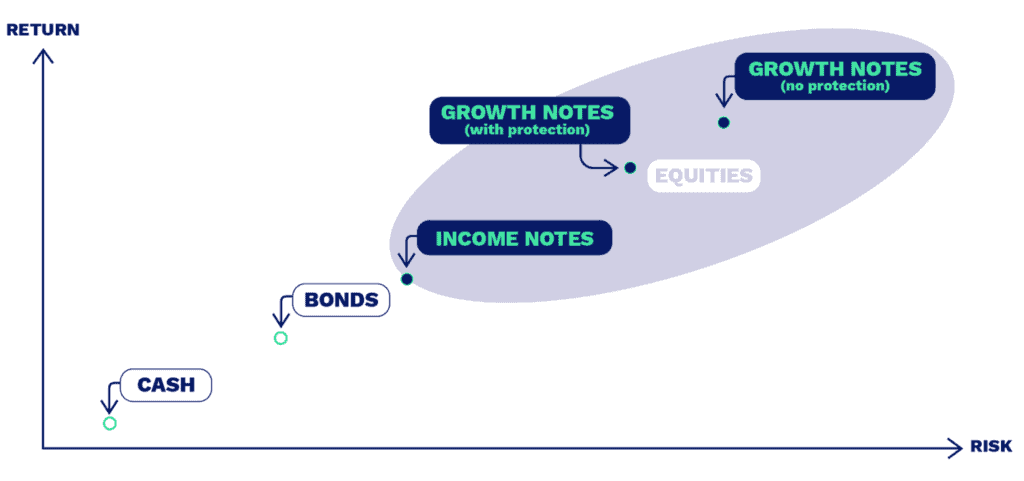

Below is a chart that provides an easy way to think about the risk and return potential in the context of other assets such as cash, bonds and equities. You will see that there are a variety of return and risk profiles. In the case of income notes, they tend to offer significantly higher income with only a slight increase in risk. Likewise, growth notes with protection offer less risk but greater return.

INCOME NOTES

Income notes seek to provide high levels of interest income instead of price appreciation. Investors receive a fixed income payment or coupon over the life of the note provided that the underlying asset(s) is above the coupon protection level.

The level of protection (also called barrier) defines the level/price at which an underlying asset(s) must be in order to receive the coupon payment and full repayment at the maturity.

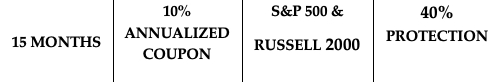

Income Note Example:

In this example, all income/coupons will be paid at an annualized rate of 10% provided that both the S&P 500 and the Russell 2000 are not down by more than 40%. As to the return of principal, 100% of principal will be returned provided that both the S&P and the Russell 2000 are not down my more than 40%. In other words, in this example, the S&P and Russell could be down 40% and investors will still get all of their money back and all of their interest income.

Soaring Capital generally invests in notes that provide protection barriers in the range of 20-40% for principal and coupon protection. We find that this the sweet spot for capturing income while at the same time providing principal protection or risk mitigation.

Growth Notes

Investment Returns with Less Risk:

In a growth note, investors receive a percentage of the underlying asset’s price appreciation with a specified amount of principal protection. The amount that the investor receives is known as the participation rate.

Growth notes combine some of the features of a fixed-income security, such as full repayment of principal at maturity (subject to the credit risk of the issuer).

Growth notes generally are designed to return an investor’s initial investment at maturity, while providing the opportunity to participate in the gains on an underlying asset(s).

Depending on the specific offering, growth notes may offer 1 to 1 upside relative to the underlying asset(s) or a multiplier to the upside for accelerated participation relative to the underlying asset(s). Growth notes typically trade off downside protection levels, participation rate and a maximum return cap.

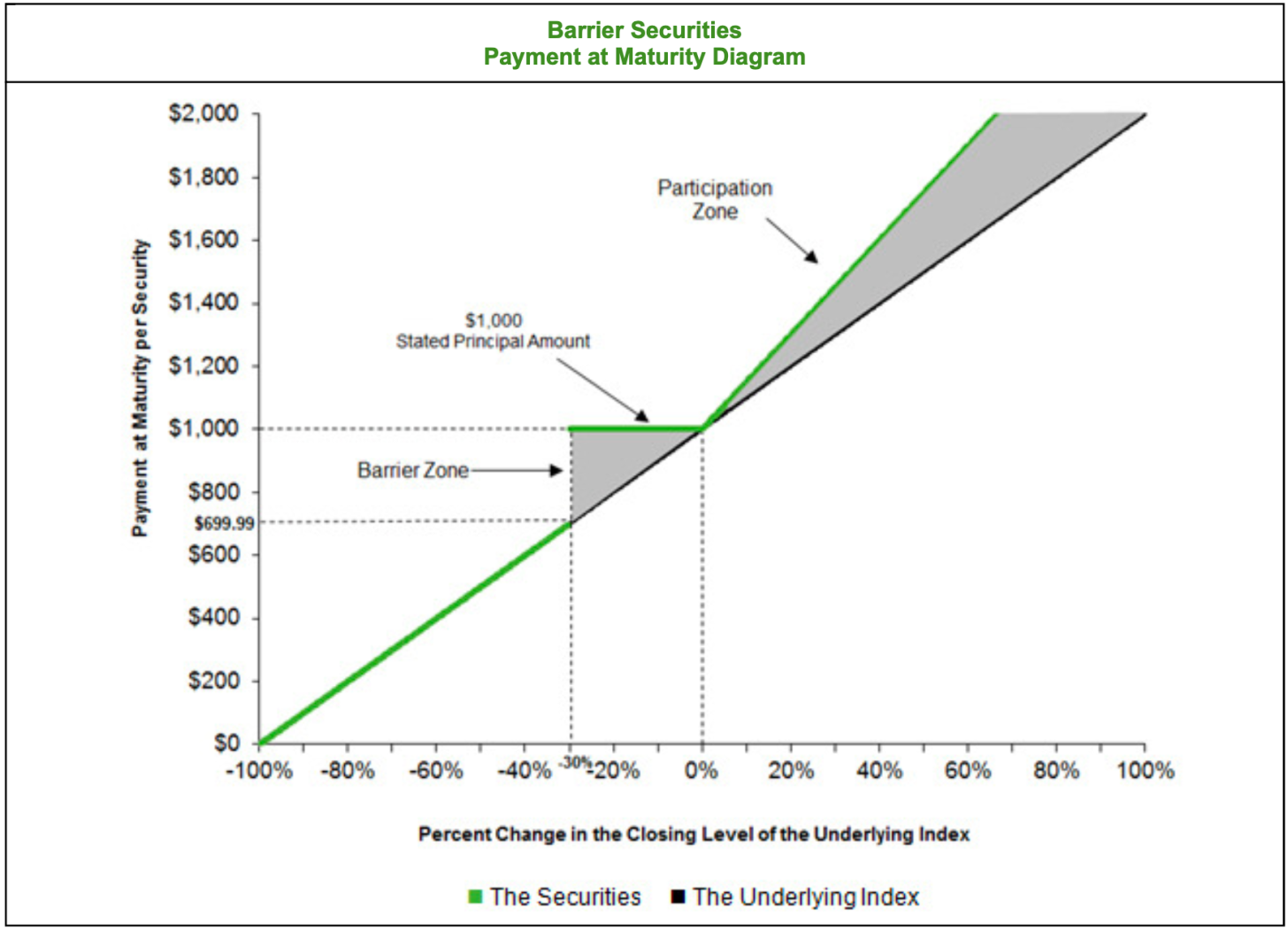

Growth Note Example:

In the above growth note example, the investor will receive the return on the S&P 500 multiplied by 1.17 while at the same time having the comfort of a 30% principal protection barrier.

Examining Various Hypothetical Return Numbers of this Note:

If the index returns 10%, the investor would receive 11.7% or $111,170 per $100,000 invested.

If the index returns 20%, the investor would receive 23.4% or $123,400 per $100,000 invested.

If the index returns -10%, the investor would receive 100% of principal or $100,000 per $100,000 invested.

If the index returns -20%, the investor would receive 100% of principal or $100,000 per $100,000 invested.

If the index returns -30%, the investor would receive 100% of principal invested or $100,000 per $100,000 invested.

If the index returns -40%, the investor would receive -40% of principal invested or $60,000 per $100,000 invested.

Below is Another Way to Visualize the Potential Return:

What Benefits do Growth Notes Provide?

Growth notes offer the returns on a basket of assets with a specific level of downside asset protection. Growth notes allow an investor to remain invested when they are uncertain about the market environment since the protection amount limits or caps the amount of potential losses.

In some cases, growth notes can be structured to produce for positive return even if they underlying assets decline in value.

What are the Downsides of Investing in Structured Notes?

Investors forgo dividends and interest that might be generated from the underlying assets. Investors may also give up a portion of capital appreciation in exchange for full principal protection. Payments on structured notes are subject to the credit risk of the issuer.

Structured notes are not as liquid as other investments. While an investor can sell a note prior to maturity, the pricing received might not be a good as one would like.

Do structured notes make sense for you?

Structured investments can provide innovative ways to invest. They allow investors to target very specific needs or beliefs. This may allow for better targeting of yield and/or return relative to the desired risk and return tolerance.

Whether you seek full repayment of principal at maturity (subject to the credit risk of the issuer), desire additional asset exposure, aim for enhanced returns, or wish to combine these objectives, a structured investment exists (or can likely be created) to address each unique need.

To determine whether these investments are appropriate, consider the following questions:

- What is your investment time horizon?

- Are you comfortable assuming the credit risk of the issuer of the structured investment for all payments on that investment?

- Are you concerned with meeting specific goals?

- Do you have specific income needs?

- Do you have a bullish, bearish, or neutral market outlook?

- Are you comfortable with the risk profile of the underlying assets?

- Are you able to invest capital for longer periods of time?

examples of growth and Income notes*

*Actual notes available as of October 2nd, 2023. Pricing varies and may be better or worse than quoted today. Refer to important disclosures at the end of this article.

Income Note Examples:

1. Ten Percent Annualized Yield Income Note

-18 month term

– Underlying Indices S&P 500 and Russell 2000

– 30% Soft Principal Protection

– 30% Coupon Protection

– Interest Paid Quarterly

2. Eleven Percent Annualized Yield Income Note

– 18 month term

– Underlying Indices: S&P 500, NASDAQ 100, Russell 2000

– 30% Soft Principal Protection

– 30% Coupon/Income Protection

– Interest paid Quarterly

3. Nine and one half Annualized Yield Income Note

24 Month term

– Underlying Indices: S&P 500 and MSCI World Index

– 25% Soft Principal Protection

– 20% Coupon/Income Protection

– Interest paid Quarterly

Growth Note Examples:

1. Eighteen Month Growth Note that offers 15% hard buffer Principal Protection

– Underlying Index S&P 500

– 150% Upside p\Participation with 18.6% cap

- – Full Principal protection down to a market decline of -15%.

2. Two Year Growth Note that offers Full/100% principal protection

– Underlying Index S&P 500

– 100% Upside Participation with a Maximum Gain of 20%

– Full, 100% Principal Protection

3. Hybrid Note with Positive Return in a Down Market

– Note based on S&P 500 and Dow Jones

– 150% participation with 45% max return

– 3 year Note, Non callable for 1 year

– If called at year one investor receives 12% payment

– If the market is down, investor receives the inverse of the decline. For example if the market is down -20% the investor receives a positive +20% return.

– If the market is down more than 20% the investor receives only the decline past 20%. For example, if the market is down 25% the investor is only down 5%.

– If the market is up 25% the investors return is 37.5%

- – If the market is up 50%, the investor receives +45%

Summary

At Soaring Capital Management, we believe that knowledge is the key to successful investing.

In this guide, we’ve explored the world of structured notes, shedding light on these investment instruments that can truly elevate your wealth strategy.

Structured notes offer a unique blend of growth potential and risk mitigation, making them a valuable addition to any investor’s portfolio. Whether you are seeking higher income, principal protection, or enhanced returns, structured notes can be tailored to meet your specific financial goals.

Our mission is to empower you with the knowledge and tools necessary to navigate the ever-evolving landscape of structured investments. We’ve covered the core concepts, different types of structured notes, and their potential benefits and risks. Armed with this understanding, you’re well-equipped to make informed investment decisions that align with your financial aspirations.

At Soaring Capital Management, we go beyond offering investment products; we provide personalized solutions that consider your unique circumstances and goals. We’re ready to partner with you on your financial journey and are here to help you chart the path that leads to your financial success.

Contact us if you are interested in understanding more about structured notes.

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control.

Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in anyway. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.