I had the opportunity to sit down with the former US National Security Advisor John Bolton and retired four-star US Marine Corps General James Jones at the Yale Club of New York on October 11, 2023.

It could not have been a more opportune time to meet with them.

Gaining insights from someone with John Bolton’s and James Jones’ national security expertise is invaluable for assessing geopolitical risk and its potential market impacts. With tensions escalating globally, they provided sobering views on how this instability could influence the economy and financial markets.

The backgrounds of Ambassador Bolton and General Jones are impressive:

John Bolton – Mr. Bolton was the US Ambassador to the UN and US National Security advisor under President Trump. Bolton held national security positions under both Bush Presidents and served as Assistant Attorney General under Reagan. He has decades of foreign policy experience at the highest levels. He has met with Vladimir Putin, Kim Jong Un, Xi Jinping, Angela Merkel, Benjamin Netanyahu and many other global leaders.

James Jones – General Jones is a retired four-star general. He reached the highest levels in the Marine Corps and in national security. He served in Europe as the commander of United States European Command (EUCOM) and Supreme Allied Commander Europe (SACEUR).

Secretary of State Condoleezza Rice appointed Jones as a special envoy for Middle East security on November 28, 2007, to work with both Israelis and Palestinians on security issues.

What is happening geopolitically now and what are the implications for the economy and markets:

What is happening geopolitically now has huge implications for the economy and markets today and in the future.

The terrible events that unfolded in Israel and now in Gaza this week are the result of a web of religious, economic and territorial disputes that date back centuries. These issues have up until recently largely been kept at bay and had shown some signs of improvement. In fact, the US was close to brokering a deal that would normalize relations between Saudi Arabia and Israel. Now all of this has been thrown into question.

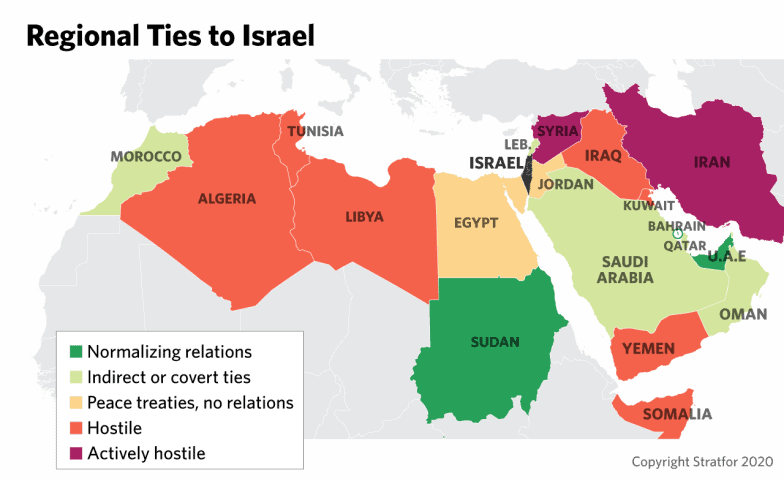

The map below is a good representation of the regional ties to Israel. Many countries are not friendly to Israel.

The following points were made by Ambassador Bolton and General Jones:

- The US needs to take a stronger, clearer stance with both our allies and adversaries.

- The world looks to the US for leadership and any sign of weakness will be viewed opportunistically. They view our leadership is currently not as strong as it needs to be

- It is too early to tell if the conflict in Israel will create a broader regional conflict. They is a lot of simmering resentment on both sides.

- It is likely that the potential deal between Israel and Saudi Arabia was the catalyst that spurred the attack by Hamas.

- Iran likely has a bigger role in the attacks than we perceive them to have at this point.

- Bolton advocates increasing US defense spending to 5% of GDP, where it was under Reagan. Today it stands at 3%.

- Bolton is on Iran’s most wanted list and was the subject of an assassination attempt in retaliation for the US killing of Iranian General Qassem Soleimani. General Jones is also on this list, but he was quick to point out that he was not as high on the list as Bolton!

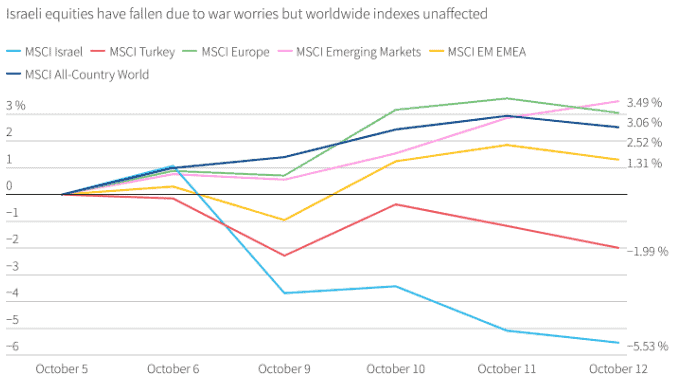

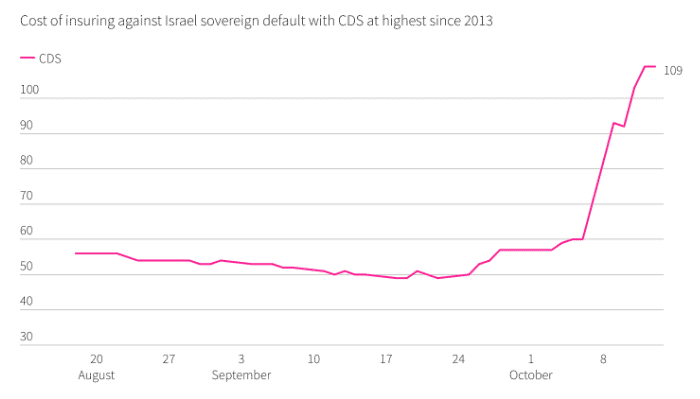

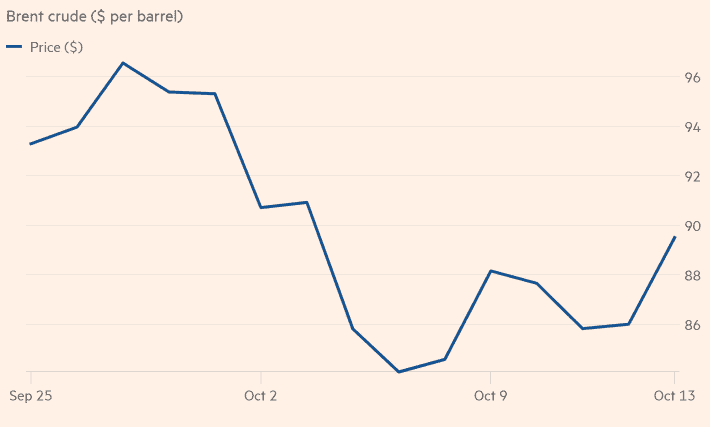

It is too early to tell what the the financial impact of this conflict will be. However, the markets have a tendency to “see through” most geopolitical conflicts and somewhat disregard them. That is, unless the conflict will have lasting and/or large global effects.

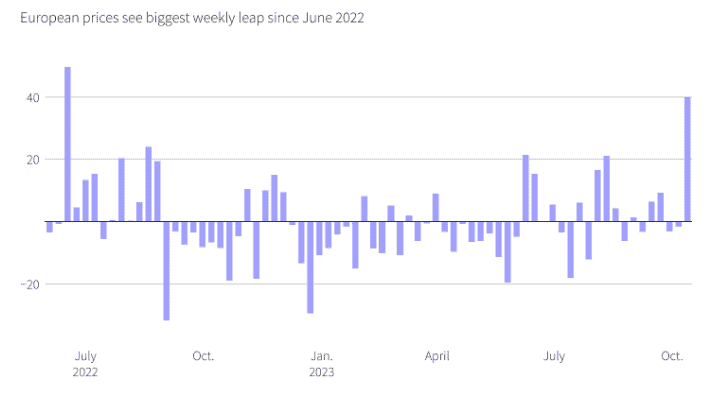

So far we have seen predictable moves in markets such as energy, gold and the US Dollar. Below are some charts that visually show these market moves:

Summary

Thank you Ambassador Bolton and General Jones for sharing your insights on this ongoing conflict. My hope and prayer is that a solution can be found in the short term to prevent further bloodshed.

The tragic thing is, as I research the history of this crisis, the same cycle of violence seems to repeat itself over and over without meaningful progress. The 2014 Gaza War had many of the same dynamics, resulting in thousands of deaths on both sides yet no real steps toward peace. While I try to remain optimistic, it is tempered by the lack of advancement.

At the end of the day, despite our differences, we are all people of this world who care for our families and wish to live in peace. I continue to pray that a just and lasting peace may come someday soon.

What are your thoughts? Do you believe we could see real peace in the Middle East in our lifetimes? Or are we doomed to see this pattern of conflict repeat indefinitely? I welcome any insights you might have on how the international community can break this cycle and help foster stability and cooperation. Please share your wisdom, as dialogue and understanding are badly needed.

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control.

Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in anyway. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.