Private equity has long been the domain of institutional investors, delivering superior returns and reshaping the business landscape. Now, a unique market opportunity is allowing individual investors to access this “superior form of capitalism” at unprecedented discounts.

Are you intrigued by the potential of private equity but deterred by the high minimum investment requirements and limited liquidity?

In this article, we’ll explore a unique opportunity to invest in private equity. We’ll reveal fund structures that allow accredited investors to access this asset class with greater flexibility and potential for exceptional returns.

For those who want to do a deep dive, we provide a brief history of private equity covering how some of the top Ivy League universities employ private equity produce class leading returns. We will cover:

- Private equity background including historical returns

- Details on what makes private equity unique

- New fund structure innovations

- How to buy private equity at a discount

- Secondary private equity fund market overview

Private equity offers a compelling opportunity for investors seeking superior returns. With current market conditions creating unique discount opportunities, now may be the ideal time to add this asset class to your portfolio.

Introduction: What is Private Equity?

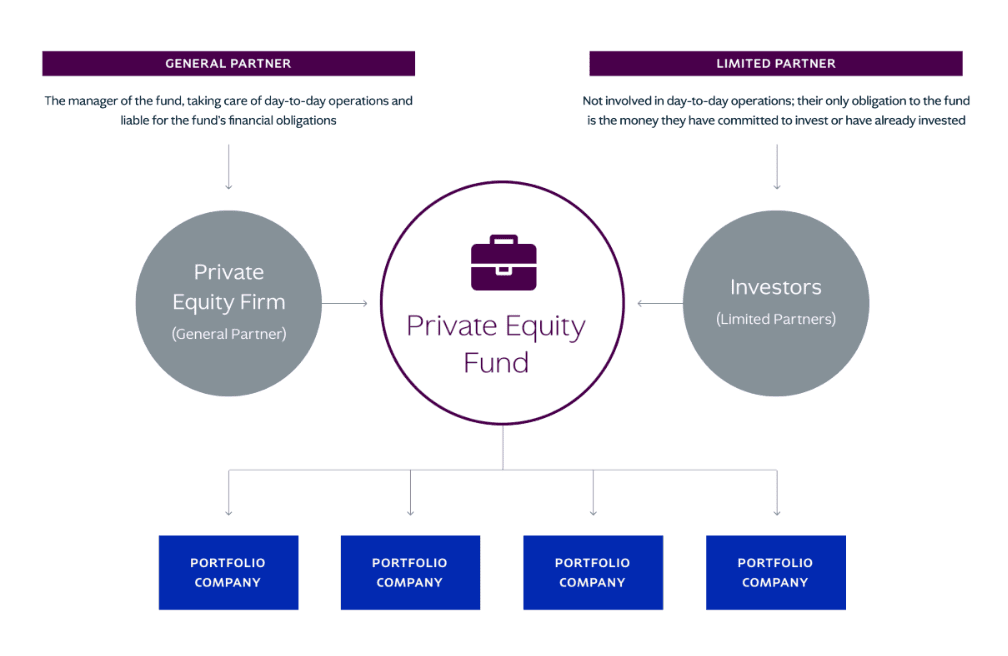

Private equity in the most simplistic terms is equity ownership held in a private business. Private equity firms are run by general partners (also called sponsors). General partners invest money raised from investors who work together for a limited amount of time, aptly named “limited partners.” Private equity firms are sometimes called buyout firms. As the word indicate these firms typically buyout an entire business. Usually the buyouts happen with a portion of equity and a portion of debt (leverage buyout).

This is not a new concept as the idea of buying a company with a pool of investors’ capital dates back over 100 years.

The Changing Landscape of Investing

Private equity firms owns a significant number of companies. It is estimated that they own over 16,000 US companies and represents approximately $5 trillion of capital.

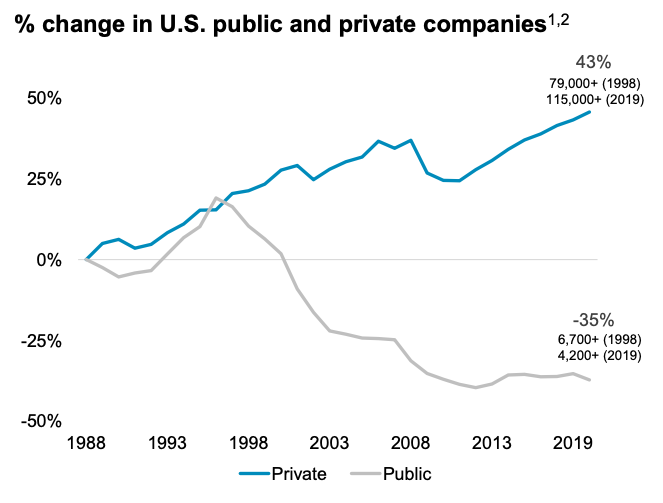

Since 1988, the number of public companies has declined by 35%, and the number of private companies has increased by 43%. This represents a dramatic shift in ownership; out of the public and into the private markets. Many more companies are choosing to remain private. Not investing in high growth and innovative companies via the private markets is potentially missing a lot of return.

Outperforming Public Markets

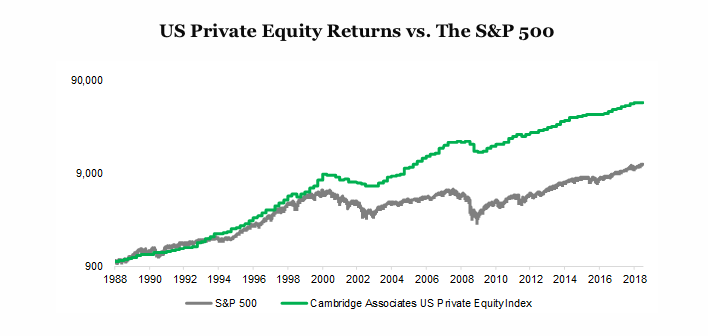

The institutional consulting firm Cambridge Associates produces a private equity returns index. Their index is a reasonable representation of historical returns. Their analysis shows that over the past twenty five years private equity has provided investors with annualized returns of +13.03%. This compares to the MSCI World return of +7.4% and the S&P 500 of 6.2%.

A million dollars invested in 1988 turns into $21m at this compounded rate versus $4.5m for the S&P.

The long-term returns of private equity are one of the reasons why Yale University and other Ivy League endowments have generated such outstanding performance.

David Swensen, Yale’s legendary Chief Investment Officer, in a discussion with Robert Rubin (the former US Secretary of Treasury), referred to private equity as “a superior form of capitalism”.

What Swensen meant by this was that private equity had long-term, patient capital and full control to drive changes. Characteristics that are not always present in public listed companies. Sometimes, the corporate changes that are needed can be hard and require a complete rework of strategy, management, operations and governance. For a public company, making the needed changes is much harder as there tends to be a shorter-term focus on meeting or exceeding quarterly earnings estimates.

Not only can private equity general partners often get changes accomplished, they often have better insights as to the right changes to make. The best private equity firms often have deep industry knowledge, deal-making abilities, operations experience, vast resources, and creativity to add value. Most importantly, they act as owners.

Over David Swensen’s time managing Yale’s endowment, he produced annualized returns of 13.7% which was 3.4% greater than the average endowment. In dollar terms, he produced over $21 billion of gains for Yale! One dollar invested in 1985 turned into $103 versus $50 for the S&P over the same time.

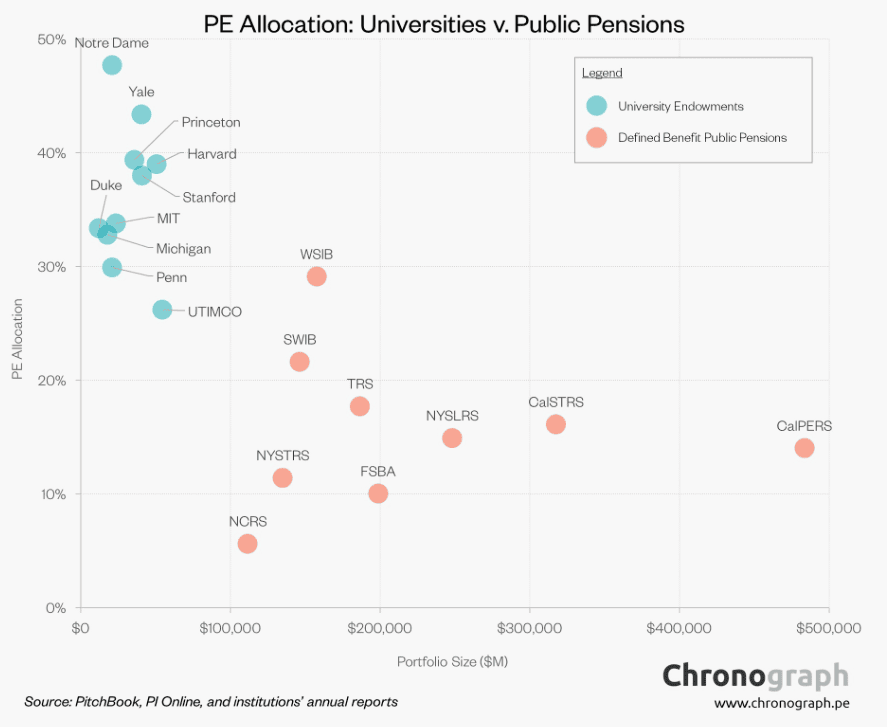

Clearly, not all of Yale’s returns were generated by private equity, but it did account for a large percentage of his allocation and return. The chart below compares Yale’s allocation (weighting) to private equity relative to other universities and to a select group of public pension funds.

Owner Mentality Creates Better Outcomes

You may recall that I worked as an activist investor with Barington Capital. At Barington, we attempted to unlock value by effecting changes at companies that we felt were undervalued. Chief executive Jim Mitarotonda, was frequently envious of private equity. As public company investors, we had minority ownership and were outsiders looking in. We had to change public shareholder opinion and attempt to sway the board that we had a better plan to get anything done. While Barington was effective at this, it was hard.

Meanwhile, private equity-controlled companies have 100% control and can do as they wish. There is 100% alignment of interest with the goal of bottom line returns for shareholders.

Furthermore, publicly listed companies are managed by executive teams and boards of directors that typically don’t have much ownership stake. This weak alignment of interests can contribute to lackluster performance.

At Barington, we examined numerous cases where CEOs were paid tens of millions of dollars while shareholders had no return or even negative returns, and yet it was still hard to get the board to make the much-needed changes.

This is not to say that private equity always has the answer. They can’t create growth at will, but more often than not, they can figure it out. Operating as an owner and entrepreneur can be very powerful.

Private equity is far from perfect, but criticisms of the industry often miss the big picture. Criticisms typically highlight a small subset of the industry or view performance over a very short timeframe. To get a taste of the criticisms, it is worth reading about a bill that Elizabeth Warren recently put forth to bar private equity from investing in the healthcare sector.

Private Equity for Accredited investors

Typical private equity fund investments in a traditional fund structure require a minimum commitment of $1m to $5m or more and therefore are out of the reach for many investors. Additionally, these investments require the investor to lock up their money for 10 years or more.

Under the traditional private equity fund structure, the investor needs to sign an agreement committing to invest in the private equity fund and then be ready with short notice to remit money. A lack of clarity around when the private equity fund will return investors’ money adds to uncertainty. While most funds are structured with finite lives, private equity funds have some flexibility to extend the ending date. This flow of funds dynamic makes it difficult to manage portfolios that contain private equity. This is one of the downsides of investing private equity via traditional fund structures.

Fund Structure Innovation – Evergreen Funds

While the majority of private equity funds are structured and operate as traditional (so called GP/LP vehicles), there have been some innovations in this area.

I am referring to evergreen funds (also called interval or tender offer). These fund structures allow investors to avoid the difficulty of managing the funding uncertainty, provide better liquidity, and accept a broader range of investors.

When investing in an evergreen fund, the investor’s capital is called upfront and is put to work immediately in the pool of assets that the fund owns. When one wants to redeem from an evergreen fund, the investor needs to provide advanced notice but the capital can normally be returned on a quarterly or semi-annual basis. [This is provided that not more than a certain threshold of total fund capital is requested at any one redemption period. Typically, this threshold is 2.5% to 5% of net asset value.]

During most environments, this fund level liquidity should be sufficient, but it is not guaranteed. Anytime there is a mismatch between the liquidity offered to investors and the liquidity of the underlying holdings, there can be issues.

On balance, it is my belief that the evolution of the evergreen fund structure is a positive development that has more positives than negatives.

The Current Opportunity: Buying at Discount

There are some very interesting dynamics happening in the private equity and venture capital sectors at the moment that are allowing investors to buy at significant discounts.

– Why do these discounts exist?

To understand how these discounts have come about, it requires an overall understanding of the private equity market, investors, and structures.

The outline from KKR provides a high level overview of the typical private equity fund structure

As discussed earlier, the vast majority of $5 trillion invested in private equity is invested in traditional private equity fund structures. These structures obligate the investors or limited partners (LPs) to:

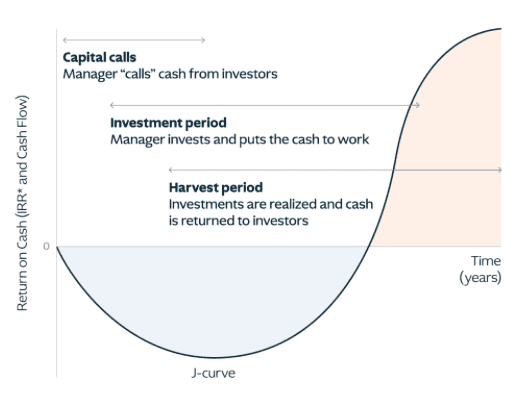

1) Provide the private equity fund with capital when they receive a capital call and; 2) Obligate the investor to be patient and hold the private equity fund shares for a period of 8-10 years. The graph below explains the life cycle of typical private equity investments.

When a private equity general partner (GP) creates a new private equity fund, they typically haven’t yet identified any underlying investment targets to buy. When an LP is investing at this point, investors are making commitments to what is called a blind pool. LPs commit a certain dollar amount which will need to be sent to the private equity fund upon request (capital call). Capital is called as investments are identified for the private equity fund to buy. This period of time is referred to as the Investment Period.

After the private equity fund makes acquisitions, it then works to unlock/create value for these companies, therefore increasing the net asset value of the total portfolio. As time passes and values increase the private equity fund will look to monetize or sell holdings and then return the proceeds back to LPs. This period is called the Harvest Period.

In normal environments for private equity, the investment period will be between 2-4 years and the harvest period will be 6-8 years. Along this timeline, capital is typically returned to investors ahead of the full 10 year fund life. As an example, an LP investor might commit $10m to a private equity fund on day one. Half of this commitment might be called at the end of year one, and the other half called at the end of year two. In year five, some of the portfolio holdings will have matured and been sold; therefore, the fund will return some capital back to LP investors. The remaining capital might be harvested and returned to LPs in year 8, and the fund is then closed out.

Market Dynamics Creating Discounts

Now that we understand the typical flow of capital when investing in private equity, let’s look at how investors manage portfolios of private equity.

The majority of investors in private equity are institutional investors (university endowments, pension funds, and sovereign wealth funds). These entities are tightly managed and guided by institutional consultants and investment boards. As a result, these investors have to abide by a strict strategic asset allocation. This allocation prescribes how much is allowed to be invested in each different type of investment. As an example, a typical board might prescribe an allocation to private equity in a band of 15% to 20% of the total assets.

Managing investments into private equity funds is difficult due to the uncertainty around the timing and amount of capital calls during the investment period and the timing and amount of return of capital during the harvest period. The trick is to understand when commitments will be called and when capital will be returned. Most investors in private equity base their commitment decisions on the historical returns of capital.

Over-Committed and Under-Harvested

What has happened recently is that many investors are now over-committed to private equity and venture funds due to the muted amount of harvests. Therefore, many investors find themselves in a situation where they are above their prescribed allocation limits for the asset class.

Harvests/return of capital have been slower than usual, while at the same time, the amount of new capital commitments has remained strong. This situation is analogous to buying a new house in advance of selling your old one. You need to come up with the funds to buy the new house before you receive the proceeds from the sale.

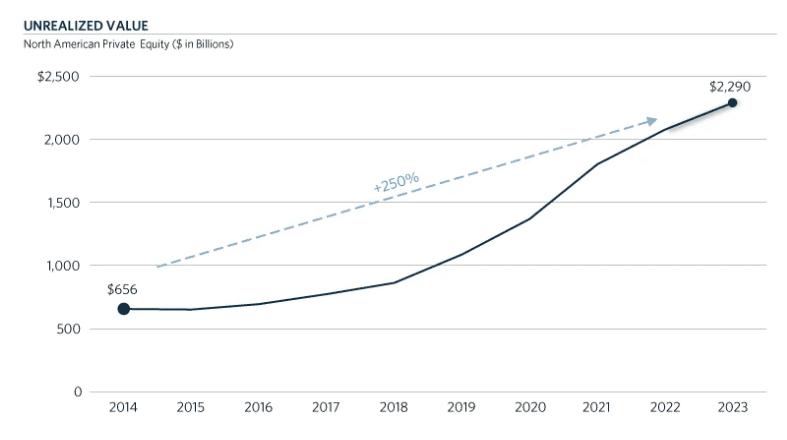

The amount of private equity harvests have been reduced largely due to the rise in interest rates and the lackluster IPO and M&A markets, among other factors. The chart below shows the amount of unrealized holdings in private equity.

Because investors are over-allocated/over-committed, they are looking to sell their private equity fund interests (LP Interests) on the secondary market.

The investor might really like their private equity fund investment, but they need to sell to get their overall portfolio back into balance. As a result of this need to sell, the investors are willing to accept a reduction from the current value of the shares. In some cases, the discount is 20%. We like buying $1 for 80 cents!

General Partners Also Need to Sell – Continuation Funds

The general partners (GPs) or managers of the private equity funds are also feeling the pressure from their investors. Not only do the GPs need to provide good returns, they also need to return capital to their LPs within the expected time. If the GP’s investors are not happy with the amount and timing of the return of capital, they are less likely to invest in the successor funds from these private equity firms.

Since a significant amount of the profit that GPs earn is only realized once the private equity fund sells their investments and returns capital to LPs, they are incentivized to sell assets. However, the amount of profit (carried interest) that a GP earns is based on the amount of profit that they make for their LPs. Therefore, GPs will normally only want to sell assets when they think they are being compensated appropriately.

Since harvests have been muted, the GPs are not able to get, what they perceive, as the full value for their holdings. Because of this dynamic, GPs are choosing to create so-called continuation funds.

Continuation funds allow the GP to provide liquidity to original LPs and for the GP to defer the selling of their assets until the pricing is better. Continuation funds are set up by GPs typically in partnership with secondary private equity funds.

A continuation fund assumes ownership of all or a portion of the private equity portfolio. This allows the GP to provide liquidity to the original LPs who want/need liquidity and at the same time allows to them hold on to prized assets that they think offer continued growth prospects. The GPs will typically roll over their ownership in the continuation fund and continue to defer their carried interest therefore, maintaining alignment.

Private Equity Secondaries Opportunity:

The secondary private equity market has existed for a long time, but today it is having its day in the sun.

Over the previous three years, the private equity secondary market has had transaction volume of over $100b per year. There are dedicated investment firms that exclusively focus on the private equity secondary market, with some having track records that go back 30 years. The best ones have great long-term relationships with both GPs and LPs to source the best opportunities.

Benefits of Investing Now?

Private equity secondaries are particularly attractive investments now due to several factors:

- Discount – The level of discounts that buyers are able to negotiate is larger than it has been historically. Some funds are purchasing LP and GP interests at 20% discounts.

- Amount of Deal Flow – Given the dynamics described with institutional investors being over committed to private equity, there is a large amount of deal flow available.

- Access – Given the creation of the evergreen/interval fund structure, accredited investors can now participate in this asset class.

- Liquidity – The evergreen fund structure offers significantly better liquidity than traditional private equity.

- Potentially Better Returns – When looking at the historical returns of secondary private equity fund managers, we observe that returns have been very strong with net returns in the mid to high teens percentage annualized rates of return. While we don’t have a crystal ball, we would expect these numbers to hold over a full market cycle. Not only does buying at discounts improve the return, but by investing in an evergreen fund, you eliminate most if not all of the traditional private equity J-curve.

- No Blind Pool Risk – When buying in the secondary market, you know exactly what you are buying, which affords the private equity secondary fund the ability to do a complete analysis of each underlying holding.

- Reduced Risk Overall – By nature, the companies that are purchased in the secondary market are more seasoned and further along their growth trajectory. Having a more seasoned company affords more data for analysis and less uncertainty about the growth path.

- Speed of Deployment – Investors’ money is put to work on day one. Investing in an evergreen fund allows you to quickly deploy capital. Having a shorter investment period versus a traditional fund is not only easier to manage, it potentially increases overall portfolio return as the investor doesn’t have to set aside money for traditional private equity fund capital calls.

Conclusion

Private equity has been one of the best places to invest.

However, as typical disclaimer language states, “past performance is no indicator of future results”. With that said, I find the wise words of Mark Twain are particularly apt in that ‘history doesn’t repeat, but often rhymes”.

Will future private equity performance rhyme with the past? We believe that well executed private equity investments with the right general partner are structurally superior. There are downsides such as fees and illiquidity; however, for the right investor with the right risk profile and time horizon, we think that these are worthy trade-offs.

Current trends suggest that investing in private equity secondaries could offer even greater returns than traditional private equity.

Given the increasing prevalence of private companies, we believe that exposure to a segment of high-growth private companies at discounted valuations is a wise investment strategy

Together with our advisors and broad industry network, we have completed extensive diligence to source the best ways to allocate to this sector. We have identified two funds that are believe are compelling to add to our client portfolios.

If you found this article interesting and would like to learn more about how Soaring Capital thinks about private equity and more broadly how we help our clients reach their investing goals, please reach out.

Will private equity be a superior form of capitalism? We think it will.

Thank you for your observations, Mr. Swensen!

All the best,

Brian F. Moss, CFA

Click here to read additional research from Soaring Capital

We help you chart the path that leads to your financial success.

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control.

Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in anyway. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.