Would you invest in office real estate now?

Office real estate has been in the financial press a lot and for good reason. Many office real estate investment trusts are trading down 50% or more. There have been a number of high profile office building defaults where the owner couldn’t support the debt payments and turned the building back to the bank.

When markets or sectors are stressed it typically pays to take a hard look to see if there are opportunities.

When thinking about value investing in real estate the person who comes to my mind for inspiration is Sam Zell.

Zell was famously quoted saying “If everyone is going left, look right.”

Zell was one of the greatest investors of our time. He made a fortune buying things that no one wanted to own. Most of what he bought was real estate.

He had nothing to prove to anyone and was always straight in his views, which were often contentious.

“Conventional wisdom is nothing to me but a reference point. In fact, I believe it can be a horribly debilitating concept.”

It often boils down to a bunch of people yelling “Go this way!” And once the crowd gets going, it can get real loud, real fast. We saw it in the stampede of commercial real estate development in the 1970s and 1980s, the dot-com craze of the 1990s, and the subprime mortgage mania of the 2000s.”

He wanted everyone’s opinion, because he saw tremendous value in being a good listener. But then he determined his own path.

Once he formed his opinion, he trusted his perspective enough to act on it. That meant putting his own money behind it. He would stay with his decision even when everyone is telling him he is wrong, which happened a lot.

Office Real Estate – where are we now?

The pandemic clearly has changed office work behaviors, and interest rate increases have made leverage more onerous for heavily indebted building owners. At the same time, the banking sector is less enthusiastic about lending to office real estate.

- Does this mean that all office real estate is doomed to default?

- Are there opportunities to buy assets on the cheap?

- Are there other, less obvious opportunities around these trends?

Looking for opportunities that others are running away from has the potential to produce outsized returns. Additionally, buying assets that are marked down provides a measure of downside protection.

While we will never have perfect information to make any investment decision, I felt it was worth my time to do deeper, on-the-ground due diligence in the office real estate sector.

Houston -Do we Have a Problem?

On May 17th, I boarded a private plane at the Teterboro Airport in New Jersey with five other investors to visit office building assets in Cincinnati and Houston. The buildings we toured were large Class A office buildings located in central or near central business districts. They all had occupancy around 80% and have had good and improving recent leasing experience with long weighted average lease terms.

Class A Versus Class B:

One trend in office real estate is a flight to quality. Lessors are choosing Class A buildings over Class B by a wide margin. The logic is that employers want to provide an incentive for their workers to come to the office. Therefore, they are choosing renovated and highly amenitized space.

A great example of this is the newly completed SL Green One Vanderbilt building in Manhattan. This state-of-the-art building has a 30,000 feet amenity floor that includes a world class restaurant by the Michelin star chef Daniel Boulud, a high-end sushi bar, cafe, shower rooms, conference rooms and a top-drawer fitness center. This building is currently approximately 99% leased and leasing at much higher rates than competing buildings.

Geographic Differences:

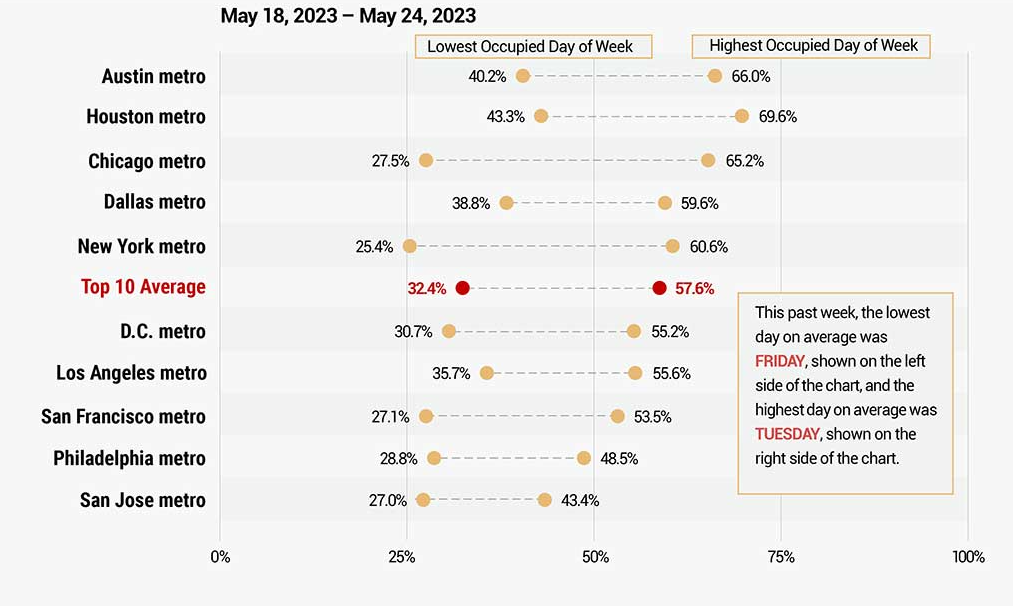

Certain cities are showing a higher proclivity of return to the office. Cities such as Austin and Houston have over 60% return to office while San Francisco, Los Angeles, Chicago, New York City, Atlanta and Boston are well below that. This is likely related to the composition of the type of work in these locations and the mindset of the employers.

Career Advancement for Work from Home vs in Office:

We are beginning to see some companies treat their remote workers differently from their in-office staff. Those who choose to work from home might not be eligible for pay increases or be afforded promotions or advancement opportunities compared with those who work in the office.

Feelings about Remote vs In Office Work:

Seventy-two percent of employees prefer a hybrid remote-office model while at the same time 87% believe the office is essential for collaborating and building relationships with team members. Interestingly, nearly 80% of employers are ready to terminate, cut pay or limit promotions for staff that don’t comply with return-to-office mandates.

More and more companies are firming up their return to the office mandates. Companies such as JP Morgan, Google, Amazon, Starbucks, and Disney have mandates ranging from a full five-days a week to three days- a week in the office requirement. Just this past week Meta tightened its policy and is now requiring employees to be in the office at least three days a week.

Distress Cycle Leading to Bankruptcy

Many Class B office buildings are, or will be, in financial trouble and will likely default.

Many publicly listed office real estate investment trusts (REITs) are over-levered and will not be able to pay their debts. This will be especially acute when the loan interest rates reset at higher levels. Since REITs are required to pay out 90% of earnings this results in minimal cash reserves which can easily result in a liquidity crunch.

In an environment where the value of the real estate has declined, owners are often not able to roll over their debt as the loan-to-value (LTV) of the existing debt is at a higher value than when it was originated. In order for the bank/lender to be comfortable with the new loan they are going to need to add equity to bring down the LTV. The problem is that there are few avenues to raise equity in this sector at the moment. Any equity that is raised will be dilutive which will lead to a dividend cut. This will likely lead to a big decline in the stock price. If they can’t sell equity, they will have to restructure in bankruptcy.

Houston Class A Opportunity

As to the office building for sale in Houston that we toured, this Class A asset is being sold at a 46% discount to the seller’s basis in 2012 and a 27% discount to comparable sales. It is selling at a 9.1% at a cap rate (current net operating income divided by purchase price) and at a 70% discount to replacement cost. It is being purchased with 72% equity and the rest via five-year term debt at a 5.5% capped rate.

The building has 630,000 of leasable square footage. Since October of 2021 it has signed 319,000 SF of new leases which means over half of the building is under relatively new lease terms and rates. The building is currently 83% leased and the tenants have a seven-year weighted average lease term.

Limited partners investing will receive quarterly distributions starting at a 6.5% annual rate. Investors will benefit from accelerated depreciation (which can be used to offset other investor income).

This particular building is being purchased from a group of investors including the largest Canadian pension fund. It is part of a portfolio of real estate that is backed by a loan from Goldman Sachs. Currently they are in default on the loan. Selling this building was identified as a way to help repay the loan while they work to save the rest of their real estate portfolio. This makes for a great discounted value play in the Class A office sector.

The group organizing this purchase plans to hold it for a long time. They forecast putting in minimal capital to upgrade and amenitize the lobby. They plan to re-capitalize building in five to seven years (refinance the 5 year loan) and pay back investors’ original investment. After investors are paid out their original capital, they will enjoy the cash flow that the building produces and still hold their equity.

I would love to hear your thoughts about Class A office real estate and opportunities you are seeing.

Is the better opportunity to wait for more distress?

Can we pick up the pieces after the market declines?

Will it decline more?

Should we short Class B office?

What would Sam Zell do?

Just like Sam, I love hearing everyone’s opinion.

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control.

Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in anyway. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.