The other day I went to my local bakery and asked for two croissants.

“Coming right up sir!” said the baker.

At this point I was salivating as these croissants looked and smelled delicious. When it was my turn to pay and woman said, “That’ll be $16.50” in a matter of fact tone.

“I only asked for two” I said.

“Yes, that’s right $16.50. Cash or credit.”

We all know that there is significant inflation now. We all feel it in our everyday lives with almost every purchase – including my $16 croissants! It is being felt more directly now that gas prices have spiked up significantly since the war in Ukraine.

The question financial advisors and investors need to ask is how to invest in the face of inflation, risk and war uncertainty?

What are the implications for the movement of interest rates, equity valuations, equity sector valuations, valuations of different countries’ equity markets, foreign currencies, etc.?

This article will unpack my thinking on these issues and at the end of the article offer timely strategies on how to manage and profit through this period.

This article covers:

- Inflation – How did we get here?

- Energy Supply and Demand

- Commodities and War

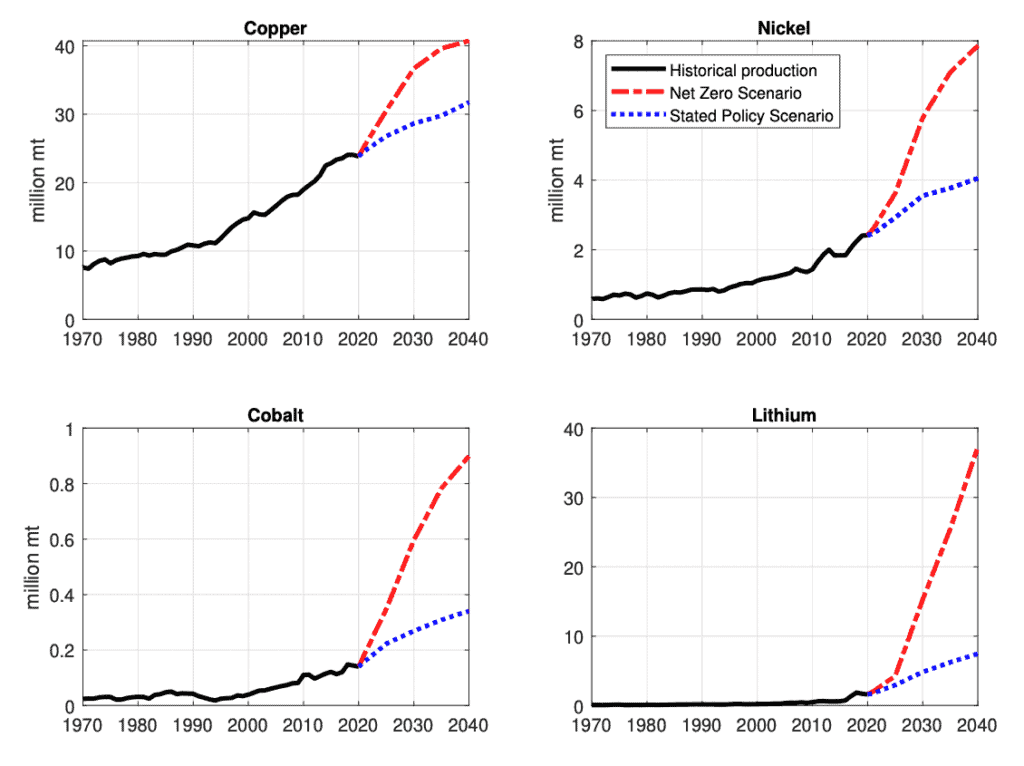

- Commodities and Net-Zero

- Equities and Equity Sectors in a Rising Rate Environment

- Real Estate Sectors and Inflation

- How to Position Portfolios Now

Inflation – How did we get here?

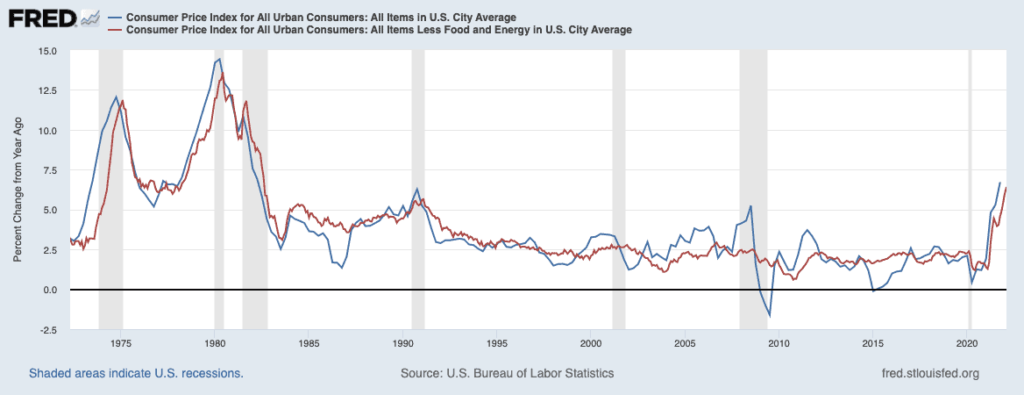

During the pandemic, the Federal Reserve Bank and the Treasury Department injected record amounts of stimulus into the financial system, increasing the balance sheet to nearly $9 trillion dollars as of today. At the same time, the Fed changed their formula for when they would respond to changes in inflation. Historically, the Fed would attempt to get ahead of inflation by adjusting in advance inflation. Today the Fed is choosing to let inflation run higher than normal.

Their thinking was that inflation would be transitory based on the idea that it was principally caused by supply chain disruptions and the post COVID economic reopening boom. Initially that was the case as inflation was somewhat limited to goods, however we now see inflation expanding from goods to services to wages and does not appear to be transitory.

Consumer and producer prices recently printed increases of ~8% each. Even if you strip out the volatile food and energy components, the numbers are still high by historical standards.

The Fed learned from the years 2009 through 2020 that they could run more stimulus through the economy and not have it show up as inflation even with an economy running at full employment.

The Fed was willing to trade off economic support for higher inflation. This created a situation where we had interest rates at historic lows and a robust economy. This resulted in deeply negative real rates of interest, i.e. interest rates below the rate of inflation. This encourages/encouraged speculation.

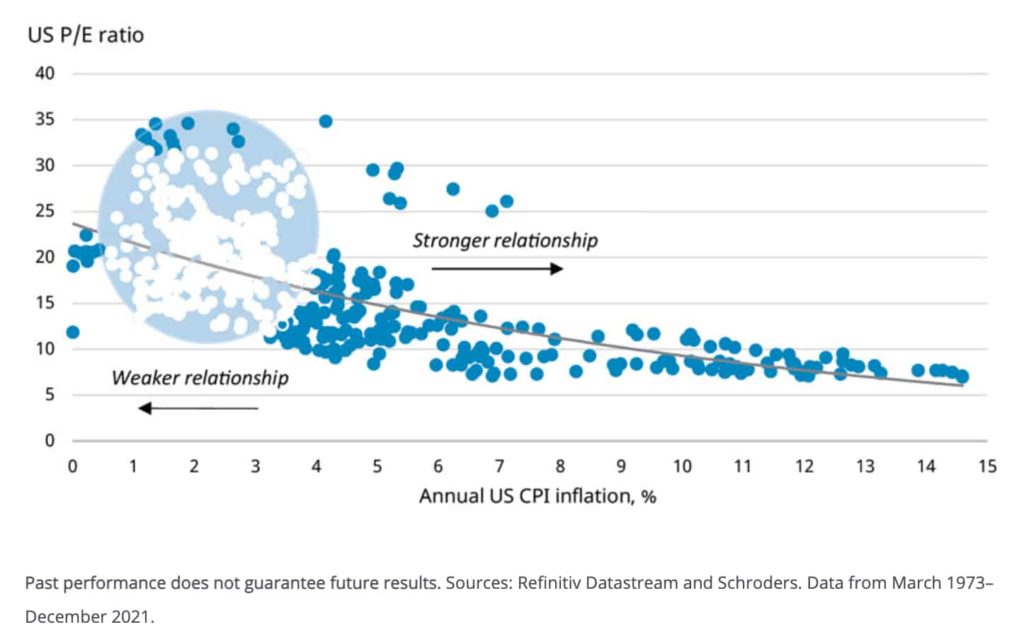

We can observe the effects low rates on the valuations of growth equities, crypto currencies, SPACs and meme stocks to name a few. One was incentivized to take risk as there was no interest to be earned in bank deposits or bonds.

One of my favorite examples of the recent effect of low rate and Fed liquidity in the market is a company called Joby Aviation. Joby is developing a vertical take-off plane taxi. “Tesla meets Uber in the air” according to their own description. I like the idea and would love to own one when they are in production. What I wouldn’t do is buy the company’s stock which went public a $6 billion-dollar valuation.

They have yet to produce a single unit and will not have one until 2024 at the earliest. The company is backed by some big names such as Reid Hoffman and Mark Pincus. Big names will only get you so far. The stock is down 70% from its high and it probably will be cut in half again from here as the company currently has ZERO revenue and is still valued at nearly $3 billion!

What worked?

I added allocations to oil, commodities and gold in client portfolios about a year ago. This was based on the following ideas:

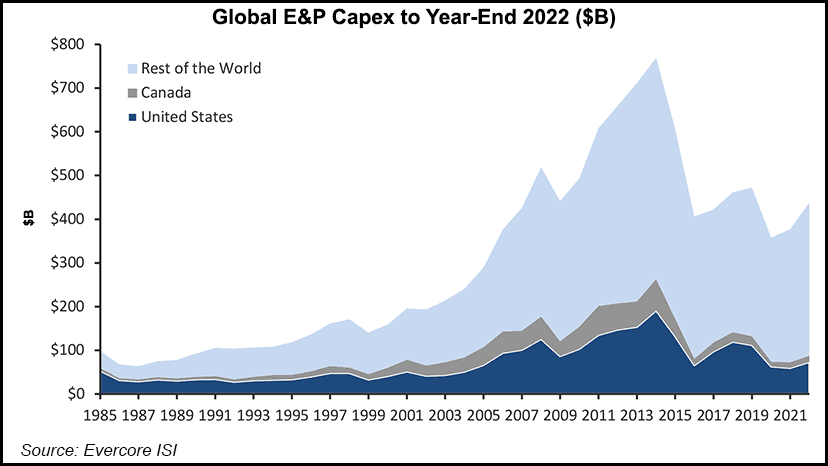

● Oil was under-invested and would be in tight supply

● Commodities would be a good inflation hedge and in high demand in a net zero carbon emissions world; and

● Gold is a good volatility/inflation hedge

This worked out well so far for clients with energy investments up over 30%, commodities up over 20% and gold up over 8% year to date.

The question is where do we go from here?

Aside from the geopolitical changes that the war in Ukraine implies for World order, the war has bolstered the concerns about supply of energy, commodities and the nationalization of production of goods generally.

Let’s try to explore these one at a time:

Energy

The global supply of oil was already tight due to the lack of investment in exploration and production, environmental concerns and net zero government policies. Spending by super major oil companies (Exxon, Shell, BP, etc.) declined by 50% since 2015 according to IEA (International Energy Agency) while demand for energy increased.

Oil and gas are inelastic commodities, meaning that supply does not change much when prices increase. The major cure for high prices is….high prices. In other words when the price gets so high demand is reduced.

Demand reduction will likely only take place at much higher prices. Some estimate that significant demand destruction will not occur until oil reaches $200 per barrel. Should the war continue and the world embargo Russian oil and gas, we will have a meaningful shortfall in global supply.

Having worked with a top energy long/short hedge fund, I learned a lot about how the energy industry works. Needless to say, there is little that we can do to increase supply in the short term, therefore we will just have to stomach higher prices for some time. While the forward Brent curve does imply a reduction in price in the future months, this price is highly dependent on the course of the war.

While the US economy is much less energy intensive than it was in the 1970s (estimated at roughly 50% more efficient) energy prices do nonetheless have an impact on spending the power of consumers in real and psychological terms.

Commodities and War

The other effect of the war is on the broader commodities complex:

Russia is currently the 11th largest economy in the world with a $1.6T GDP just behind that of Canada and 20% less than Italy’s economy. In spite of Russia’s smaller economy, it accounts for a large percentage of the worlds’ commodity exports outside of energy. Commodities such as palladium, diamonds, platinum, iron ore, aluminum, nickel, copper, wheat, corn coming from Russia and Ukraine account for a high percentage of global supply (over 40% in the case of Palladium).

A reduction in the supply of these commodities has the biggest effect on Europe but does have global repercussions for many industries.

In general commodities and commodity producing countries are under owned as investments. This represents an opportunity for smart investors. The countries that have large resource exporting businesses are Brazil, Australia, Canada, South Africa. We have already seen this play out with the Brazilian markets up over 18% YTD.

Trade-off: Inflation VS. War

In the absence of the geopolitical situation in Ukraine, we would expect the Fed to increase rates fairly aggressively to cool inflation however given the Russian/Ukrainian, conflict that calculus is up for debate.

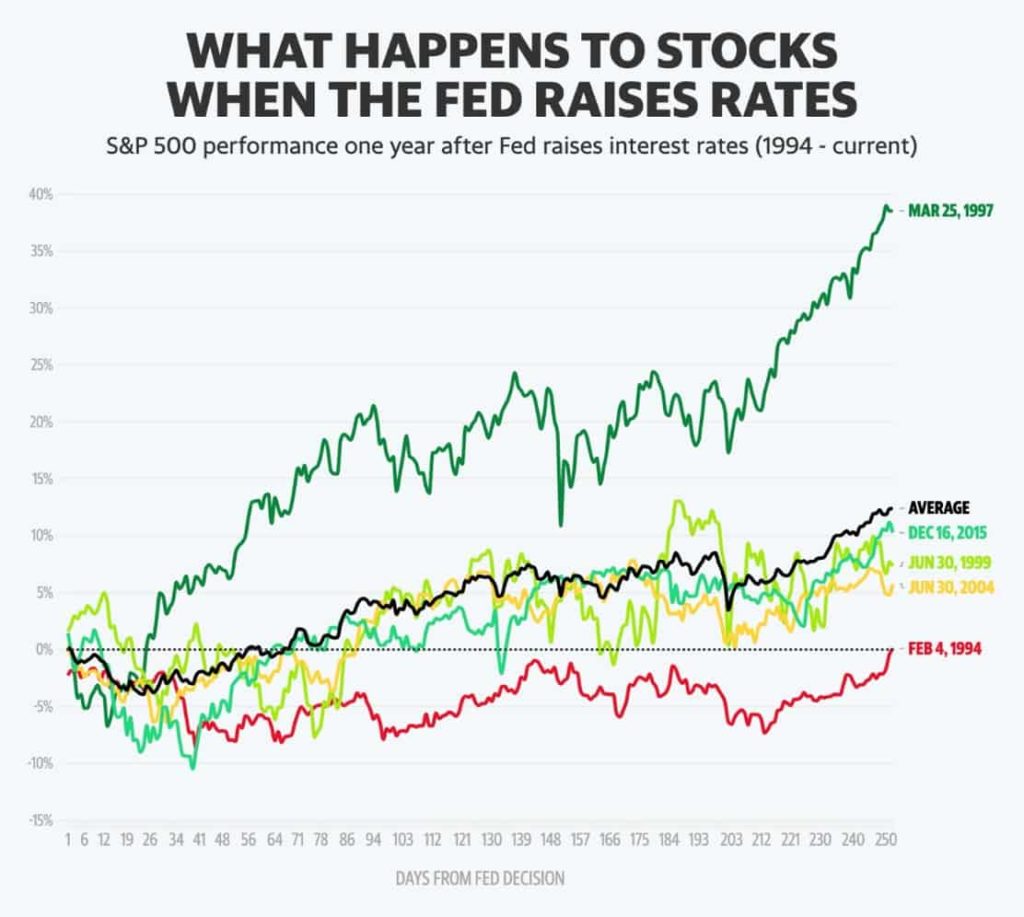

The Fed increased rates 25 bps on March 16th and Jerome Powell is guiding to 6 more increases this year. This still leaves real rates negative but this will have the effect of helping cool the economy and help manage inflation. I believe that they will be cautious and will adjust their policy so as not to tip the economy into a recession. While the probability of a recession has increased, we are not modeling a recession. My sense is they will tolerate more inflation to allow the economy to keep expanding.

The data would indicate that after rate hikes that equities are well supported after an initial drop. See the chart below.

Risk and Uncertainty

To be human is to be stressed with what is happening in Ukraine. This emotional response is natural and can affect how we think and invest. The war has created big risks and uncertainties for investors. There are key differences, however, between risk and uncertainty. We can manage risk with hedging, insurance and other strategies, but uncertainty is not manageable and demands flexibility.

One doesn’t know how the war in Ukraine will unfold.

● When will it end?

● Will Russia stop at Ukraine or be aggressive with other countries?

● What will the effect be on the US Dollar?

● Will the dollar lose influence as Russia trades more in Yuan or crypto?

● What effect will the sanctions have on supply chains and movements of money?

● What exposure do Western banks have to Russian counter-parties?

● How does China respond?

● Will the comparative advantage of free trade be restricted, if so for how long?

What can be said for certain is that there are many unknowns and uncertainties which will result in market volatility. We are likely to see increases in equity, rates, FX and commodity volatility.

HOw to position portfolios

History would indicate that it is best to invest when fear is high. While this is hard to do, it can provide great returns. I added to investments at the depths of 2009 and 2020 and have learned to assimilate lots of data and listen to my gut.

As discussed above, one area of investing that is likely to benefit is volatility. So how does one profit from volatility?

1. Long Volatility

Long volatility strategies benefit from higher market volatility. Quantitative, global macro and trend following strategies have elements of being long volatility.

I have deep experience in this sector with a personal history of allocating hundreds of millions of dollars in this space. I have identified a particular fund manager that profits when market dislocations happen. This particular fund has a negative correlation to the S&P and has provided nearly double the return of the S&P since inception. Inclusion of investments like this may improve a client’s total portfolio return at the same time dampening the overall risk.

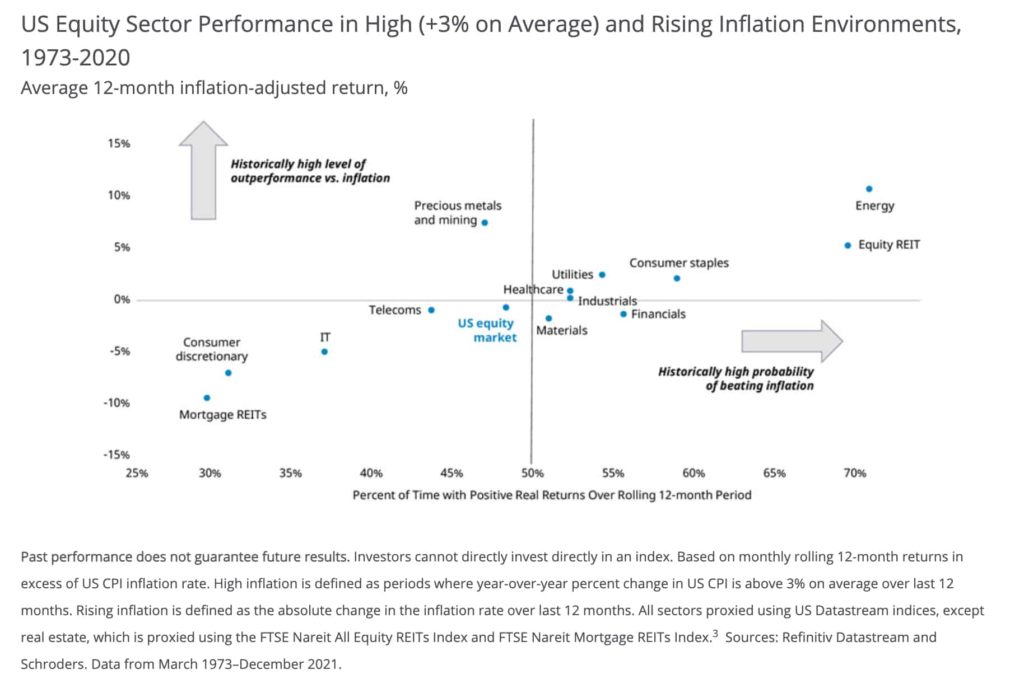

2. Inflation Sensitive Equities

Certain sectors of the economy are more sensitive to inflation than others. In general, equities are good long term hedges against inflation as companies are generally able to pass along higher input costs to consumers. Some equity sectors are better able to cope with inflation than others. The best sectors as inflation hedges are: precious metals, consumer staples, utilities, real estate, materials and financials.

3. Debtor Strategies and Short Duration Assets

When rates are rising one wants to keep debt investments short in duration and/or own adjustable rate debt instruments. There are many interesting ways to capture increased rates via high quality floating rate bonds or by owning short duration loans that cycle quickly, such as short duration real estate bridge loans.

4. Extend Debt and Increase Leverage

One personal finance strategy is to extend debt obligations. For individuals, this might mean refinancing out of a floating rate mortgage into a 30-year fixed rate mortgage. For companies, this means issuing long duration debt. If inflation is persistent, then the debt service payments that one makes are devalued with each year that passes. Let inflation do the work for you.

5. Real Estate

Certain types of real estate can act as a good inflation hedge. Real estate sectors that have frequent payment resets tend to grow income over time and keep up with or exceed inflation.

Single or multi-family rentals, storage real estate as some that have allocated to. Rent payments are typically adjusted annually and typically adjust with a positive correlation to wages and inflation. Owning this type of real estate is like owning a bond that has an increasing coupon and future principal payment.

6. Resources and Resource Rich Countries

Certain materials and natural resources are undersupplied. With supply further constrained by the Russia conflict, this area of investing may provide good long term areas for allocation. If you factor in demand from a net-zero carbon world the forecasted need for resources increases even more. See the charts below from the International Energy Association (IEA) projections for demand for copper, nickel, cobalt and lithium.

Allocating to countries that will benefit from increased resource demand are likely to benefit two-fold: One the companies that are producing the resources are likely have higher earnings power and two the country’s currency is likely to appreciate. This has the potential to benefit the investor on both fronts. We like investments in Brazil and select individual resource companies.

7. Value Equities

Creating an equity allocation strategy that includes growth and value can provide portfolio balance. In inflationary environments, high P/E stocks tend not to perform as well as low P/E stocks. In this environment, we tend to tilt more than usual to value equities and blue-chip growth companies.

I hope that you enjoyed this article. I look forward to discussing and/or debating these ideas with you.

Sincerely,

Brian

Disclosures*

This research note/blog post is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control. Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in any way. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

3 thoughts on “Profiting from Inflation, Volatility and Uncertainty”

Hi Brian: Now that it’s war on, what do you think about defense stocks? Now there is a hypersonic missile we need to figure out how to shoot down, more cyber threats, and China which is much more technologically advanced than Russia, making invasion noises. I’m thinking that sector is poised for a new round of growth. Also, who pays for Ukraine to get re-built? We are looking at hundreds of billions, how will that affect the world economy? Will it be a boon for construction or suck up capital from all over the world and make money more expensive? Best regards–Alan Kriegstein

Hi Alan, I do think that defense companies will get a lift in earnings/sales from the war now and going forward. Year-to-date, most of the major defense companies’ stocks are up approximately 15% while the S&P is down ~6%. The world has changed with the invasion of Ukraine and most government defense budgets are being approved at higher levels. Sadly the world does need to spend this money to protect our society and way of life and that money spent on defense will not be spent on other things. It would be much better if we didn’t have to spend this money.

As to rebuilding, I imagine that the world will come together to help rebuild. I haven’t studied it but I wouldn’t imagine that it would have a material impact on the use of global funds being sucked out of other uses. We can look to what happened in Kuwait after the Iraq invasion in the early 1990’s. The costs to rebuild were a couple of hundred of billion dollars. Kuwait is much smaller than Ukraine however therefore the cost is going to be much higher. The likely beneficiaries of this rebuilding are the large construction companies like Bechtel, Flour and heavy equipment manufacturers like Caterpillar.

Best, Brian

laudantium animi eos corrupti corrupti cum ad neque ut animi eligendi maiores voluptatem quae et saepe corrupti. explicabo minima eos nisi corrupti nisi nam et quae fugiat minima pariatur ut. repellen