While we can’t control the economy, markets or tax policies, crafting a well-structured plan empowers us to achieve our financial goals.

In this article, I outline ten actionable items that will set you up for a successful 2024. You will learn tax-saving strategies, investment moves, retirement planning tips, and more.

1) Investment Moves

✓ Rebalance your portfolio

This year proved to be a year of haves and have-nots. Some investments had outstanding performance while many had flat to slightly positive returns. A market like this typically requires a portfolio rebalance to stay in line with desired asset allocations and risk tolerances.

Many names in the S&P have had gains of 50% or more this year. Nvida was up +230%, Salesforce up +97%, Amazon up 78%, Tesla up +103%, etc. If you held these companies, and others, it might be prudent to examine if their valuation is warranted relative to their growth rates. Additionally, it is worth examining if their appreciation has caused your portfolio to be unduly concentrated in a sector or in a single name.

✓ Avoid chasing past performance

Stick to an asset allocation plan and do not chase yesterday’s winners. The market tends to move in cycles and chasing a cycle is often not a path to long term success.

✓ Evaluate weighting to cash

With short term yields on money markets offering around 5% interest, it is tempting to have a large weighting to this risk free asset. However, this can be dangerous in the context of meeting your long term goals. One should stick to a strategic asset allocation plan and have an appropriate amount of cash.

Separately, if you have cash sitting in a bank earning next to nothing, the incentive to move money out of the bank remains stronger than ever.

✓ Consider an Investment Policy Statement (IPS)

Having a clearly written investment policy provides a measure of discipline. This captures goals, risk tolerance and other considerations to help achieve your objectives and avoid market noise.

2. Required Minimum Distribution (RMD)

If you are 73 years old and older, you must take a required minimum distribution from your tax deferred accounts. Failure to take this withdrawal, will subject you to a penalty of 50% on the not withdrawn amount. If you don’t need your RMD cashflow, it is worth exploring options such as donating some or all of your RMD to a charity via a Qualified Charitable Distribution (QCD).

3. Charitable Giving

When it comes to charitable giving, there are numerous creative options that should be explored:

✓ Qualified Charitable Distribution

Using a Qualified Charitable Distribution to satisfy your RMD provides a triple benefit. For one, it satisfies your need to take RMD. Second, the distribution is not counted as income, which reduces your tax obligation. Lastly, it benefits the charity.

✓ Donate Appreciated Stock or other Non-Cash Assets

If you need to rebalance your portfolio and/or have a large concentration in a single position, it might make sense to donate some or all of the investment versus selling it and donating the cash proceeds. Not only will this provide a deduction and therefore reduction in your taxes, it will also eliminate the capital gains tax you would have to pay.

✓ Donor Advised Fund (DAF)

Use a donor advised fund to donate your assets. This allows you to receive the tax deduction for the current value of the assets in the year of donation. Additionally, it allows you to retain control over how the assets are managed, when the assets are sold and when and which charities ultimately receive the funds. You can choose to have the assets grow within the DAF and then later donate the funds to charities.

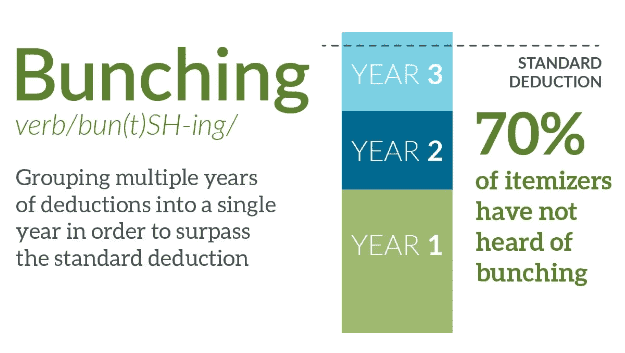

✓ Bunch Charitable Contributions

Bunching multiple years of contributions into a single year might allow you to get over the IRS standard tax deduction amounts and into the itemized deduction category. Doing so might allow you to reduce your overall tax obligation via charitable contributions versus donating the same amount each year. If you marry “bunching” with a donor advised fund donation, you are still able to donate to your favorite charities each year.

We have a calculator that will allow you to calculate if bunching makes sense for you.

Click here to use the calculator:

4. Roth Conversions

A Roth Conversion transfers your tax deferred assets into tax exempt assets. Doing this requires you to pay taxes on the converted amount in the current tax year. However, once the taxes are paid, these assets are tax-free even after they might grow and compound in value.

Additionally, these converted assets are not subject to required minimum distributions and are not counted as income for tax purposes. Having lower reported income in retirement has the benefit of reducing your medicare insurance premiums.

With the US government spending significantly more than it is collecting, it is highly likely that future tax rates will need to be increased to cover our budget deficits. If tax rates are likely to increase, it makes it a more compelling argument to convert some or all of your IRA, SEP IRA, SIMPLE IRA, or 403b plan into a Roth either this year or next.

It is important to evaluate your personal income and tax situation before making this change. However, if you determine that your income will be higher in the future or you plan on moving to a higher tax state, this might be a smart money move. If the tax burden of a lump sum conversion is too high, you could consider spreading if over several years.

Note: I typically advocate for a balance of tax deferred and tax exempt assets. I will examine many factors such as age, future income, tax policy, inheritance and others when working with clients.

5. Review Beneficiary Designations

Retirement account and life insurance policy beneficiary designations supersede the directives laid out in a will. Therefore, it is important to review these to ensure that they are set up in accordance with your wishes.

This is especially important if someone in your family recently passed away or if family dynamics changed.

Having assets pass to someone you do not want to is not an unheard occurrence (such as an ex-spouse). This is a good reminder to ensure retirement and life insurance account beneficiaries align with your current wishes.

6. 529 College Savings Accounts

As someone who is personally facing large college/university tuition bills over the next 7 years, I am keenly aware of the cost of higher education. Many private schools total cost of attendance (COA) is in the mid $80k per year! Therefore it is imperative to do long term financial planning for this expense.

Using a 529 Account can help save for school as well as provide a full or partial state tax deduction on the amount of the contribution. Over 30 states provide this benefit. Additionally, distributions from 529 plans are excluded from taxable income.

Furthermore, 529 plans have high contribution limits. Many states allow total contributions of up to $500k. Using these plans can be a great estate planning tool for families that have high income and/or a substantial amount of assets.

While contributions are limited to the annual gift tax exclusion limit of $17k per year, one can “superfund” a 529 account by investing up to $85k in a single year. Doing this allows the 529 account to generate compound returns with a higher base of assets. This should result in a larger ending balance when the time comes to pay for your child’s education.

If you use superfunding, you simply have to file tax paperwork that recognizes the superfunded contribution split over five years.

Any contributions above these limits will count towards your lifetime gift tax exemption which is currently $12.9m for single filers or $25.8m for married couples.

529 Rollover to Roth – Beginning in 2024, 529 account balances (up to $35,000) can be converted to a Roth IRA in the name of the 529 beneficiary. This could be a great way to get children started on their path to saving for retirement!

Note: 529 accounts that are owned by grandparents will not affect eligibility for need based financial aid and will not factor into FAFSA calculations.

7. Tax Loss harvesting

Selling securities that are at a loss can be used to offset capital gains. When done properly, it can result in tremendous tax benefits. Simply swapping investments at a loss with other similar securities allows one to realize the loss while still maintaining the same exposure. It is best to couple this with portfolio rebalancing.

At the end of the day, it is not about what you earn, but what you keep!

8. Employer Retirement Plans

Utilizing company retirement plans is one of the best ways to save for retirement and this time of year is a great time to review them. Factoring in the company matching this free money can go a long way.

Review how much money you contributed in 2023. If you are able to, it is worth maxing out your 401(k) or 403(b) accounts. The limits for this year are $22,500 before company matching or $30,000 if you are 50 or older.

Roth versus Traditional IRA – If you think you are in a high income year, then a traditional IRA makes more sense. If you are in a low income year, then contributions to a Roth IRA make more sense.

Review your investments inside your retirement plans – Determine if your investment allocation within your retirement accounts is reflective of your risk tolerance, time horizon and goals. Note: it is important to marry this analysis with all of your other assets that are held outside of your company retirement plans.

Business Owners – Business owners without a company 401(k) plan can easily establish a SEP IRA or SIMPLE IRA plan. You can save up to $66,000 or up to 25% of compensation in these plans.

9. Budget and expense Planning

It’s important for investors to plan their expenses for the future. The following areas should be reviewed:

✓ Cash-flow Planning

Having a detailed plan for what you anticipate spending and how you will pay for those expenditures is key to having the confidence to invest and spend. This is particularly important for retirees.

✓ Sequence of return mitigation

It is important to have adequate cash in your rainy-day account. Typically three to six months is a good rule of thumb for those who are working and retirees are advised to have more.

This will help mitigate the sequence of returns risk. This refers to having to make withdrawals from investment accounts when investment positions are down in value. Mitigating this risk can help lengthen the time your assets will be there for you in the long term.

10. Income Tax Planning

To minimize your overall tax obligation, it is important to have a good handle on what your tax liability is before the end of the tax year. We recommend running a mock tax filing with all of the information that you know at this point in the year. Since most of your income has likely already been earned, you can estimate what your tax liability is for the year.

Once you know this information, you can try to accelerate deductions and defer income to take advantage of lower marginal tax rates.

final thought

While we are all very busy at this time of year, it is worth stopping to take some time to evaluate where you are financially. Making these smart moves now can have a big impact on your future and your chances of success.

At Soaring Capital Management, we go beyond investment products; we provide personalized solutions that consider your unique circumstances and goals.

Reach out to arrange a time to walk through the best year-end planning opportunities for your own portfolio using the link below.

We help you chart the path that leads to your financial success.

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control.

Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in anyway. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.