Article by Paul Schott April 8, 2025

Watching the gyrations in the stock market in the past couple of weeks has been an uncomfortable experience for many investors — particularly those near or at retirement banking on their 401(k).

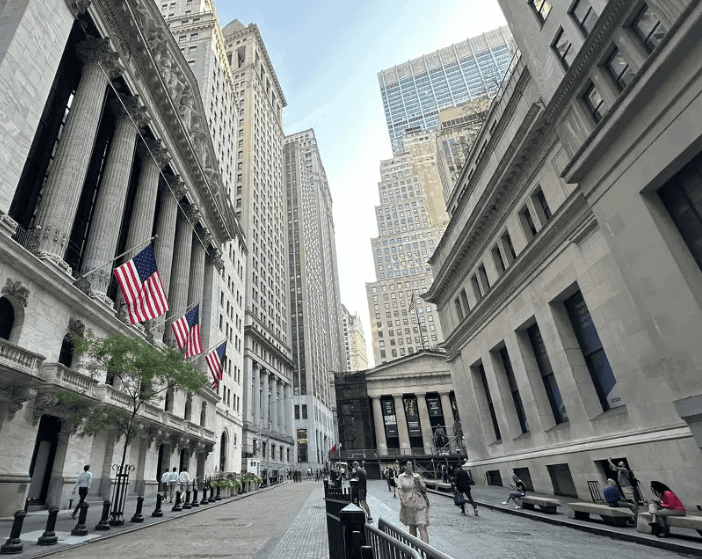

After President Donald Trump announced on April 2 a sweeping round of new tariffs, a rout over the next two days on Wall Street erased more than $6 trillion of market value. Despite the turmoil, a number of financial professionals in Connecticut are urging investors to put the situation in perspective and remain focused on their long-term objectives.

“The market turmoil is a reaction to uncertainty,” said Raymond H. Bovich, a chartered financial analyst who is a partner and wealth manager at Wooster Square Advisors LLC, a wealth management firm based in New Haven. “A significant policy change has been announced, and the markets are digesting the news, trying to sort out what the ultimate impact would be. And it’s resulting in this volatility.”

The performance of the S&P 500 index, a bellwether of Wall Street’s health, highlights the recent turbulence. It plunged 6% last Friday as it closed its worst week since March 2020, when the COVID-19 pandemic was hammering the global economy.

More ups-and-downs followed Monday. A false rumor that Trump was considering a pause in tariffs boosted markets for a short time before the White House repudiated those unfounded reports, which was followed by a precipitous drop. The incorrect information was spread in large part through social media.

By the end of trading on Monday, the S&P 500 had dropped another 0.2%. At that point, it was down 17% from the all-time peak that it reached on Feb. 19. The recent downturn put it near the threshold for a bear market, which is generally defined as a prolonged decline in stock prices in which one of the major indices falls more than 20% from a high. Conversely, a bull market refers to rising asset prices or the expectation of increasing prices in financial markets.

“This is not comfortable,” said Daniel J. Friedman, CEO of WMGNA Tax-Out Financial Solutions, a financial advisory firm headquartered in Farmington, of the current situation. “But you’re going to be OK, even if you’re not feeling OK.”

As part of their reassurances to investors, wealth managers are emphasizing that the stock market continues to generate significant long-term gains. At the end of trading on Monday, the S&P 500 was still up about 80% over the past five years. Two other major stock indices, the Dow Jones Industrial Average and Nasdaq Composite, have risen, respectively, by about 60% and 90% during the past five years.

“Equities are really the place to be over a long period of time,” said Brian Moss, a chartered financial analyst and CEO of Soaring Capital Management, a Darien-based wealth management firm. “The markets are a bit like the ocean tide, and it’s natural for them to ebb and flow.”

Stock indices’ upward trajectory over the long term has demonstrated their ability to withstand a range of pressures, Bovich said.

“It’s not my first crisis, it’s not my first bear market,” Bovich said. “I was here for COVID, the great financial crisis, the tech bubble and the stock market crash of 1987. The markets and the economy are all about adaptation and evolution. And that’s what’s happening now.”

Investors can adapt by keeping faith in tested strategies, Bovich noted.

“These experiences are a gut check for people,” Bovich said. “You review your investment objectives, risk tolerance and time horizon. Are they still accurate or do they need to change? And then you review your investment selections. Are these still the right investments for you?”

Investors can also navigate upheaval in the stock market by doing a comprehensive assessment of their finances, including a review of their ability to weather a potential recession, Friedman said.

“Make plans so that you don’t have to dip into things that were meant for the long term, for the short term,” Friedman said. “That also means having some sort of handle on your cash flow, expenses and debts — the kinds of things we should be doing all along.”

pschott@stamfordadvocate.com; twitter: @paulschott

Written By

Paul Schott is a business reporter at Hearst Connecticut Media, writing about the issues affecting small- and medium-sized businesses and large corporations based in southwestern Connecticut, with a focus on Stamford and Greenwich. He previously covered education for Greenwich Time and general assignments for Westport News.

Soaring Capital’s latest research regarding Navigating Trump’s 2025 Tariff Policy.