Five Hidden Tax Strategies to Use Now

This research note explores my thoughts on the state of economy and tax policies and puts forth timely ideas on how private client investors can reduce the impact of taxes and improve after-tax performance.

A couple of years ago, I had the pleasure of having dinner with the famed economist Art Laffer. Laffer was a member of President Reagan’s Economic Policy Advisory Board and is famously credited with guiding US tax policy during the Reagan administration with the elegant concept of the Laffer Curve. The Laffer Curve illustrates that there exists some tax rate between 0% and 100% that will result in the government receiving the maximum tax revenue for the government.

Laffer used his curve to convince president Reagan to lower the top tax rates from 70% to 50%! This large reduction in taxes is one of the main reasons why the economy boomed during the Reagan years. While some have argued that the 1980’s boom times were the result of increased government Cold War spending and the decline in the price of oil, tax policy certainly also had a big effect on economic growth.

Today we find ourselves in a very different situation than we were in 1981 when Laffer sketched his curve on a napkin at the Washington Hotel in front of President Reagan, Dick Cheney and Donald Rumsfeld.

“What is the difference between a taxidermist and a tax collector? The taxidermist takes only your skin.”

– Mark Twain

In 2021 the top federal income tax rate is 37% and long-term capital gains tax rates cap out at 20% + a 3.8% Net Investment Income Tax. Additionally, the estate tax exemption is at $23.4 million for a married couple and corporate tax rates are at historic lows. At the same time that we have historic low tax rates, the level of accumulated government debt is at an all-time high. Total debt to gross domestic production (GDP) is at a ratio of 125% and the current deficit for 2021 is forecasted to be $3 trillion. This means that the government is spending $3 trillion more than it receives. *

As we articulated in an earlier note, since the start of the pandemic, the amount of fiscal and monetary stimulus that the US government has spent totals nearly $5 trillion. This is equivalent to 25% of GDP. It is no surprise that the equity markets rocketed and bond yields collapsed since the beginning of the pandemic.

Based on the economic need for the government to collect more tax revenue and spending needs growing, Congress is pushing through a reconciliation bill that is likely to result in the tax code increases for 2022 and beyond.

So, what are some smart money moves that one can do now to position ahead of any tax increases?

There are some well-known strategies that can help improve your overall tax efficiency such as maxing out tax deferred accounts [401(k)s, IRAs, Roth(s)] and doing a backdoor Roth conversion.

The five tax related investment strategies detailed below are less well-known and can be very impactful for accredited and ultra-high net worth investors.

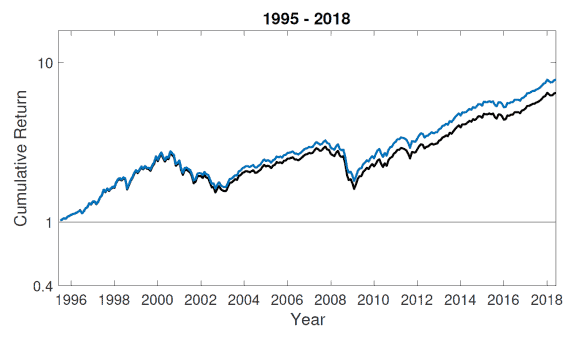

1. TAX OPTIMIZED DIRECT INDEX

Employing a direct indexing investment strategy allows for super powerful customization of:

- Tax Harvesting

- Market Exposure

- Environmental, Social, Governance, Sustainability and Impact Investing

What exactly is direct indexing?

Direct indexing is accomplished by buying the assets that comprise an investment index such as the S&P 500 directly instead of buying an ETF or mutual fund that tracks that index. The benefit of doing this is that you have that ability for complete customization of the direct index. Customization may include optimizing for ESG/impact goals, value factors, size factors, capitalization weightings AND beneficial tax harvesting.

Effectively you have the opportunity to earn a much greater after-tax return by optimizing the management of investments.

Imagine earning the return of the S&P 500 index in a given year but at the same time generating tax losses equal to $5,000 to $50,000 or more per year. These tax losses can be used to reduce quarterly estimated tax payments and therefore have a real cash effect on the balance that the investor maintains.

This is one of the more powerful forces in play on Wall Street now as it takes advantage of tremendous advancements in financial technology and the elimination of trading commissions. In volatile market environments using this strategy can be particularly powerful as was the case in 2020.

2. OPPORTUNITY ZONE INVESTMENTS

The 2017 Tax Cuts and Jobs Act created Opportunity Zones (OZs). Opportunity Zones are geographic areas in the United States that are designed to support economic development in designated low-income communities. There are thousands of such zones throughout America spread all across all 50 states. By reinvesting realized capital gains into Qualified Opportunity Zone Funds an investor can reap significant long-term investment and tax benefits.

Investments are made into specific funds that have been designed and qualified as Qualified Opportunity Zone Funds. There are tremendous tax benefits for making such investments. These include:

- Deferment of capital gains

- Step-up in basis on original invested capital

- Exclusion of capital tax on new gains

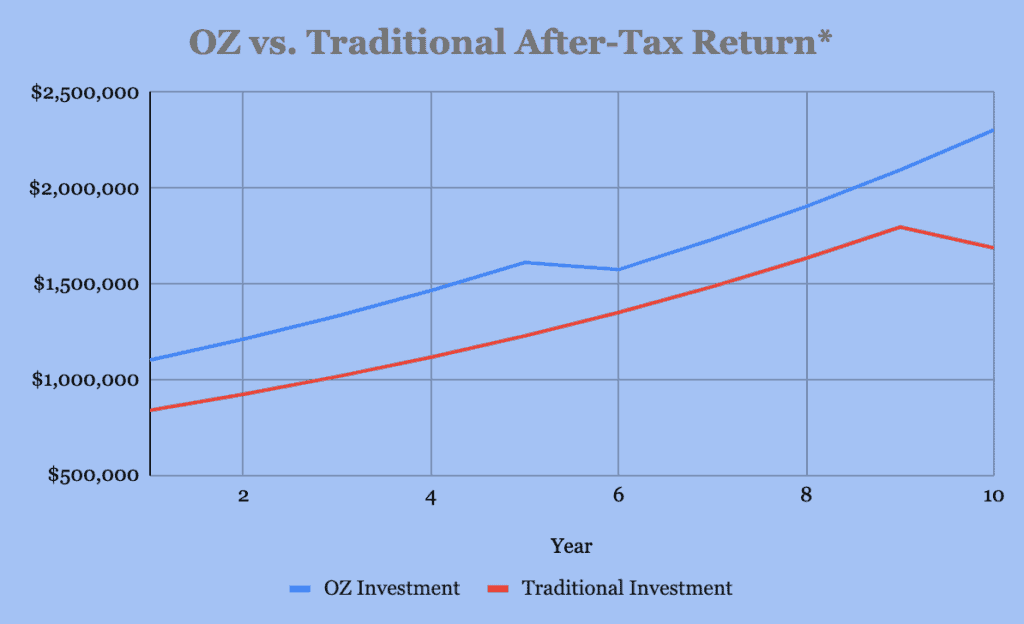

The tax benefits of OZ’s can be incredibly powerful especially for those who can hold the investments for a 10-year period.

Many investors have significant unrealized investment gains in their portfolios which may be causing their overall investment allocations to be out of line with their target allocations. Under ideal conditions one would rebalance their portfolio by selling some of the positions that have appreciated significantly and then repositioning the funds back into other investments that haven’t performed as well. However, many are reticent to sell their appreciated positions for fear of the tax bill they will have to pay.

A Qualified Opportunity Zone Fund can help in this scenario. Assume that you have $1,000,000 in investment gains that you wish to realize. If you sell and pay the capital gains taxes, you will owe $238,000 on that gain. This is a significant drag on performance. Alternatively, if you invest the $1,000,000 gains within 180 days of realizing the gain into an OZ Fund you can defer the gain for five years after which you receive a 10% step up in basis and only pay taxes on 90% of the original gain. If you then hold the OZ investment for a total of ten years you will not owe any taxes on the investment gains that the OZ Fund generates.

It is worth comparing different scenarios and looking at the after-tax performance of investing via an OZ Fund versus other less tax efficient investments.

The hypothetical after-tax return analysis indicates the OZ Fund investment outperforms by 53%*

Click here for the full hypothetical return analysis.

Note: An Opportunity Zone investment can be used in invest capital gains from stocks, bonds, real estate, private partnerships and others.

3. DELAWARE STATUTORY TRUSTS (DSTs)

For investors who have investment real estate, Section 1031 of the Internal Revenue code specifies that investors can exchange one investment property for another like-kind property and not pay any capital gains on the sale of the first property. Utilizing a 1031 exchange program one can perpetually defer the capital gains taxes as long as the investment is held in a 1031 exchanged property. One issue with a 1031 exchange is that you are limited to invest only in properties that are very similar to the one you are selling. This may limit your flexibility with regards to how you reinvest the sale proceeds i.e. if you are selling an apartment for $1 million, you are limited to buying another apartment with the proceeds.

However, with a Delaware Statutory Trust (DST) 1031 exchange, you can exchange your sale proceeds into different property types and still maintain the tax deferral. Additionally, you can diversify your investments across multiple DST 1031 properties and types. There are DST 1031 properties available as low as $100,000 each.

DST 1031 properties are typically institutional-grade and professionally managed and come pre-packaged with debt and equity. DSTs are available in industrial, multi-family, hospitality, self-storage, medical, commercial office space, student housing or single tenant retail. Additionally, DST 1031 exchange properties might qualify for depreciation allowances which further increases the appeal of this structure for real estate investors.

4. EXCHANGE FUNDS

Exchange funds are private funds that allow an investor to contribute appreciated stocks into an investment pool in exchange for pro-rata ownership of a diversified investment fund (exchange fund). The benefit of an exchange fund is that it allows an investor to diversify their investments while at the same time deferring capital gains taxes.

Individuals and families who have been investing for a long period of time likely have accumulated significant unrealized gains in individual investments. Additionally, the significant growth of some investments versus others has likely caused a portfolio allocation imbalance. For instance, if you had invested $50,000 in Tesla three years ago your investment would be worth approximately $850,000 today leaving you with an $810,000 unrealized gain. The numbers are “worse” if you had invested in a stock like Apple. If you invested $100,000 in Apple 20 years ago, that investment would be worth approximately $5 million today. These gains are likely much greater than other investments which have likely caused a portfolio imbalance.

In many situations, investors are reticent to sell or trim the highly appreciated positions due to not wanting to pay capital gains taxes. With an exchange fund, you can sell or trim the position while at the same time diversifying your holdings.

The issue of large disproportionate holdings also comes into play with many corporate executives and public company board members who may have received stock grants that are now worth millions of dollars. Use of an exchange fund may be beneficial in this instance as well.

5. OIL AND GAS PARTNERSHIPS

The US government offers significant tax benefits to encourage energy exploration and production. Many of these benefits are not found anywhere else in the tax code. Some of the incentives to encourage domestic energy production date back to the early 1900s. While there have been changes to the code over the years regarding alternative energy production, the base rules have been largely unimpacted. Today these tax incentives are still available for investors interested in the oil and gas sector.

An investor can achieve the following tax benefits by investing in an oil or gas general partnership:

- Intangible Drilling Costs – Intangible drilling costs include everything but the actual drilling equipment. These expenses generally constitute 60-75% of the total cost of drilling a well and are 100% deductible in the year incurred. They are an “above-the-line” deduction that can reduce any income type from any source. As a simple example, someone who earns $500,000 and makes a qualifying energy investment of $100,000 will be able to pass through a loss of ~$75,000. This loss will decrease their adjusted gross income to $425,000 and save potentially ~$30,000 or more in taxes.

- Depletion Allowances – Depletion allowances allow for the 15% of income distributions to be tax free for the life of the partnership.

- Depreciation Deduction – Tangible drilling costs associated with drilling may be depreciated over a seven-year period. These expenses are 100% deductible.

- Growth on Tax Savings – Money that is not taxed is available for investment; this further compounds the tax benefits.

Note: Intangible drilling costs are exempted from alternative minimum tax.

SUMMARY

Taxes will most certainly be changing for the 2022 tax year and beyond. The contemplated changes are likely to significantly impact a broad spectrum of Americans.

While we don’t know exactly how taxes will be changed, the current discussion is around changes in capital gains, income tax rates and estate and gift tax exemptions. These are all likely to be increased, and the income levels for qualifying for the highest rates will presumably be reduced which will impact a broader base of families. These changes are expected to have a significant impact on the after-tax earnings and net income.

The investment strategies put forth in this piece are valuable investment strategies to reduce and/or defer taxes even in absence of increased tax rates and more restrictive tax policies. Increases in tax rates will make these strategies even more impactful.

Soaring Capital has performed due diligence on all of the above strategies and has identified premier investment options for each of these solutions. We welcome a conversation around these ideas for qualified investors.

Sincerely,

Brian F. Moss, CFA

Disclosures*

This research note is for illustration and discussion purposes only. It is not intended to be, nor should it be construed or used as, investment, tax, ERISA or legal advice, nor any recommendation of, or an offer to sell, or a solicitation of any offer to buy, an interest in any security. Advisory Services are only offered to clients or prospective clients where Soaring Capital Management, LLC and its representatives are properly licensed or exempt from licensure. Investing involves risk and possible loss of principal capital. No advice may be rendered by Soaring Capital Management, LLC unless a client service agreement is in place.

Pro-forma portfolio illustrations shown are represented gross of advisory fees and expenses and presumes the reinvestment of investment income. Any descriptions involving investment models, statistical analysis, investment process and investment strategies and styles are provided for illustration purposes only. Client Investments will vary based on the unique goals, objectives and other factors. No representation or warranty is made that any Soaring Capital Management, LLC investment portfolio, process or investment objectives will or are likely to be achieved or successful or will make any profit or will not sustain losses. Past performance is not indicative of future results.

The information contained herein is as of the date indicated, is not complete, is subject to change, and does not contain all material information, including information relating to risk factors. Any assumptions, assessments, intended targets, statements or the like (collectively, “Statements”) regarding future events or which are forward-looking in nature constitute only subjective views, outlooks, estimations or intentions, are based upon Soaring Capital’s expectations, intentions or beliefs, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions and economic factors, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond Soaring Capital’s control. Future evidence and actual results could differ materially from those set forth in, contemplated by, or underlying these Statements. In light of these risks and uncertainties, there can be no assurance and no representation given that these Statements are now or will prove to be accurate or complete in any way. Soaring Capital undertakes no responsibility or obligation to revise or update such Statements.

Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by Soaring Capital based on a variety of factors, including, among others, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance.

This research note is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.